One of the challenges that comes with any new business is finding customers. It’s no different for iGaming and online sportsbooks, now that states are increasingly legalizing online gambling and sports betting. That’s why DraftKings and FanDuel are spending more on TV ads than they are on any other marketing channel.

Trying to convert television viewers to online bettors may seem counterintuitive. These companies are using a traditional, non-digital channel to try to acquire customers for a modern digital platform. As it turns out, though, it’s actually a very effective strategy. Here’s why.

The ‘Big Three’ for online gambling and sports betting

The battle for the top spot in the US market is a tight one.

FanDuel is the US online gambling and sports betting leader, with 31% of the market, as estimated by its parent company Flutter. FanDuel generated $800 million in revenue during 2020, according to the company’s latest financial report.

Due to that dominant position, industry analysts are expecting Flutter to offer a FanDuel IPO by July. Wall Street analysts have also valued FanDuel at $35 billion or more, based on a comparison with its competitor, DraftKings. They value the latter company at $28 billion, and mark DraftKings up somewhat because of its greater market share. Other industry insiders believe both companies are overvalued.

Meanwhile, BetMGM recently revealed that it considers itself the market leader for iGaming, with a 23% market share. During the same Apr. 21 announcement, the company also estimated it would soon be second in the nation for iGaming and online sports betting combined, right behind FanDuel.

On Apr. 28, one of BetMGM’s parent companies, MGM Resorts International, said February was a fabulous month for the brand. During that month it held:

25% of the iGaming market;

17% of the online sports betting market; and

22% of the total iGaming and online sportsbook market.

BetMGM generated $163 million in revenue during Q1 2021, up 114% vs. the previous quarter. That first quarter figure also totaled “nearly 90% of full-year 2020 revenue,” according to the April 21 announcement. Because growth is picking up, owners MGM and Entain plan to invest $450 million in the brand in 2021.

Being a familiar name isn’t always enough

It may seem like US online gambling sells itself, but it’s a product like any other. That means brands need to familiarize their target audiences with their products, especially new ones.

Another thing that may be surprising to those who follow the industry closely: Americans, by and large, don’t actually know a lot about the Big Three.

On BetMGM Investor Day, the company touted MGM’s 84% brand awareness status as a marketing win. It says that it’s the top reason BetMGM “resonates with both sports and iGaming players.” However, that familiarity stems from their familiarity with the retail properties of MGM Resorts International, which is only half of the company. The BetMGM product itself is built on technology supplied by the other half of the partnership, Entain, with which most Americans have no prior experience.

DraftKings has been in the game for nearly a decade, and FanDuel is three years older. Both were infamous in 2015 for annoying US sports fans with their omnipresent and frequent commercials about their respective daily fantasy sports products.

However, there’s a difference between knowing a brand and knowing about all its products. Plus, it’s no longer 2015. What the companies are doing now bears only a faint resemblance to what they were doing then.

For instance, when’s the last time you used your Amazon Fire tablet? It was one of the hottest consumer devices in 2015, but already seems like a thing of the past. On the other hand, you probably have recently ordered something from Amazon’s website, or watched a show on Amazon Prime.

Americans know about Amazon. Most have also heard of MGM, DraftKings and FanDuel. Nonetheless, they won’t go out of their way to find out about a new product – even if they already know and use the brand. They have to presented with new information when it’s relevant to them, followed by a call to action.

In other words, even Americans who are familiar with these operators’ names don’t necessarily know that they now offer legal sports betting and casino games. Many don’t even know whether online gambling and sports betting are legal in their state, until they see the new commercials.

Why are DraftKings and FanDuel spending so much on TV?

Brand awareness is a mass marketing game.

Marketers know television and other mass marketing methods create brand awareness and direct mail is the go-to customer acquisition tool. Those marketers also know both channels are more expensive than digital marketing, but they get results.

Much like customer preference centers let marketers know how to contact their brand loyalists, responses to marketing channels let marketers know how to use them so that consumers will respond in a desired way.

First, the Big Three’s marketing teams had to figure out their goals. Then they could figure out what marketing methods would best achieve those goals.

They may have evaluated each channel within this framework. For instance, direct mail has a high ROI and TV can boast of what’s often the best brand awareness in any marketing campaign or program. That generally means marketers should use mass marketing to drive ROI, or employ direct mail to create brand awareness.

In that same vein, only the less-skilled marketers use digital channels for “spray and pray” customer acquisition efforts. The fallout of spam complaints in email marketing alone can make that choice untenable.

Using this email marketing example to further explain how channel choices make a difference in desired marketing results, observers can note that companies with skilled marketing teams will only message opted-in customers with targeted, relevant, dynamic messages.

So, despite the cost, the Big Three appear to be achieving their marketing goals with these TV ads. Those commercials then drive viewers online, where a certain number of them click to download the gambling apps.

That’s one of the reasons search marketing budgets are so large – it’s often the funnel for all brand awareness efforts.

Did consumers see a TV ad and want to find the app? Search helps them find it. Did consumers see car wraps, billboards or YouTube videos? Search. A display ad? Search.

Relatively few searches result in clicks. Those that do, however, result in consumers being converted into customers. That’s why organic search gets credit for 75% of conversions resulting from digital marketing methods, according to recent research from LeadG2.

Are the television ads worth it?

DraftKings and FanDuel, at least, seem to be getting results from their TV ad spending. BetMGM’s numbers are less clear, as MGM reports BetMGM’s results as “omnichannel” ROI.

DraftKings averaged 883,000 “unique payers” spending $51 each month during 2020, the company told the US Securities and Exchange Commission.

Considering DraftKings spent 86% of its March and April 2021 marketing budget on TV, we can assume television was a double-digit portion of 2020’s $495.2 million sales and marketing expenditures, too.

Regardless, DraftKings’ marketing sum took nearly 81% of its $614.5 million 2020 revenue.

Marketing expenditures by FanDuel, Fox Bet, TVG, PokerStars and Betfair Casino brands “more than doubled to £348 million, increasing as a percentage of revenue to 50%,” Flutter reported about 2020.

Flutter justified the pounds sterling marketing investments by saying they were for new state launches, continuing to acquire customers in states in which FanDuel already operated and re-engaging customers who’d fallen off when pandemic shutdowns stopped sports activity.

Both had to outlay at least $1 million on commercials during the NFL season to be considered for a “Top Creatives by Attention” honor in the iSpot.tv NFL Ad Center.

During the first week of the NFL season, DraftKings purchased a 30-second spot that received 32,741,728 viewer impressions. Not all of those game fans will convert to DraftKings customers, but that’s a lot of brand awareness.

In Week Five, also known as October 2020, FanDuel became a top creative with 211,483 impressions on its commercial.

BetMGM isn’t listed, which is consistent with its position as an iGaming brand first and foremost.

Entain, which owns half of BetMGM, spent £541.5 million in 2020 to market its 24 brands, which are mostly online casino, poker and sportsbook entities. Entain’s marketing spend for its online brands was £80.7 million higher than 2019, but was an “artificially low” 20.4% during 2020 – because sports teams didn’t play during the worst of the pandemic.

DraftKings scores big in the Super Bowl

There’s a reason brands launch major marketing campaigns during the Super Bowl. Even during the pandemic, 96.4 million people watched 2021’s Big Game.

That many eyeballs in one place are just too hard for marketers to ignore. That’s why DraftKings dove into the expensive world of Super Bowl advertising.

One 15-second commercial greeted football fans during the second quarter. That was followed by a second spot during the third quarter, telling viewers they could win $1 million for getting a fourth-quarter prediction challenge right. The overall pool was $55 million.

Adweek noted that a 30-second Super Bowl ad cost $5.5 million and DraftKings also purchased in-stadium branding that would be visible during the game for eight minutes.

During its investor day in March, DraftKings said this of its daily fantasy sports app:

“Revenue from in-game contests grew 150% YoY and 170% for the Super Bowl.”

The numbers for how many customers DraftKings acquired from the DFS ads during the Super Bowl will come out on May 7.

Until then, the explanation for how DraftKings’ 5 million paying DFS players will help the brand with online casino and online sportsbook launches is in the March presentation.

“[The] DFS paid user database across 43 states creates a significant base for future OSB and iGaming users as new states go live.”

Does customer acquisition cost more than it should?

Deluging states with marketing and promotional dollars can help operators gain market share.

In Q1 2021, Flutter gained more than 900,000 new customers in the US – where FanDuel accounts for 91.6% of the company’s revenue. What helped with that acquisition were the “high levels of engagement around Super Bowl and expansion into two new states. Our total average monthly players grew by 132% to 1.6 million. We recorded a 36% share of the online sportsbook market during Q1.”

As BetMGM put it, “Player acquisition costs drive upfront cash burn,” according to its Apr. 21 brand presentation. Yet that’s the plan for the first three months of rollouts in each state. Year Three is when BetMGM thinks it can expect steady profitability in a state.

More critical analysts eyeing the low-margin business say acquisition costs are too high. Riad Shalaby is the chief marketing officer for Audience Acuity, which offers customer acquisition products and services, and he thinks there are better options.

On Thursday, he told Online Poker Report that he knows how operators can bring costs down and increase their profits:

“As the iGaming industry expands across America, the central operating question challenging senior leaders involves marketing costs – specifically, rationalizing the costs of player acquisition. Today, it is not uncommon for player acquisition expenses to range from 50-100% of revenue. This doesn’t include product, technology or taxes.

“Everyone knows this isn’t economically sustainable. The real debate is about optimizing marketing expenses to capture and retain as many players as possible, without unnecessarily burning through all of the company’s cash. It’s a tricky new twist on a land-based business that’s now being driven by a new audience and 200 million connected cellphones.”

The Big Three convert their customers online

Just about every direct-to-consumer campaign now converts online. Brand awareness efforts are starting to adopt the same plan. In the case of iGaming and online sports betting apps, doing so is a no-brainer.

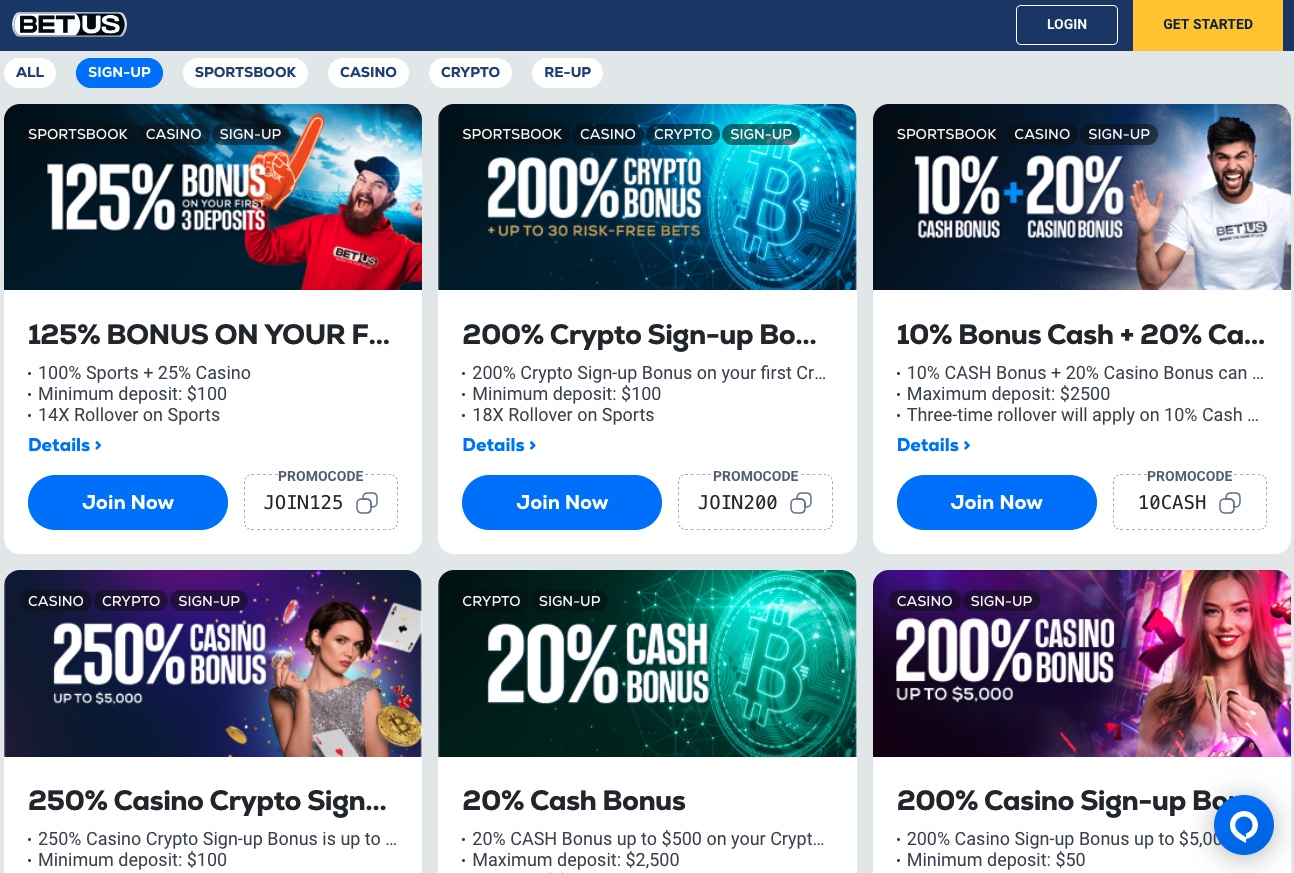

DraftKings has even added direct marketing into the mix, with promo codes liberally sprinkled in with the calls to action. It’s also using those codes to track which efforts are bearing the greatest fruit.

In DraftKings’ NFL regular season commercial that won the iSpot.tv award, consumers were urged to download the app and use the promo code “Countdown” to enter the pool for a $10,000 prize. During the playoffs, the code to enter to win $1 million was “Playoffs.” Leading up to the Super Bowl, the $55 million prediction challenge commercial urged viewers to use the promo code “King.”

Varying promo codes in that way allows marketers to determine which ad or campaign converted best. The most frequently used codes can be presumed to correspond to the most successful spots.

Right now, there are far more states with legal online sports betting than there are with online casino gambling. However, because the iGaming market brings in far more revenue than online sports betting, it’s worth looking at how those operators convert consumers to customers.

Online casino app commercials talked about card games, slots and bonus offers. These didn’t, however, include obvious tracking mechanisms for each ad like the bonus codes. Whether these videos advertised BetMGM, DraftKings or FanDuel, all were pure-play brand awareness spots.

Some ads are easily tracked because of the channel they employ. YouTube ads are one example. When using such channels, operators can check which ads converted the highest number of viewers. Even so, without a call to action, they’re relying on potential customers to use search to find the app or locate it themselves on the App Store or Google Play.

It’s an interesting choice to make the online casino app commercials almost purely brand awareness spots, with very little targeting beyond selecting for legal states. After all, casino users are known to be the most valuable type of online gamblers.

In New Jersey, iGaming revenue is twice that produced by online sports betting. In Michigan and Pennsylvania, it’s three times as high. West Virginians playing online casino games have created 1.5 times as many tax dollars for the state as its online sports bettors. All of these numbers are from March 2021.

Thus, the strategy being used by the Big Three may seem unorthodox, but it’s clearly working for them.

This article is a reprint from OnlinePokerReport.com. To view the original story and comment, click here.