A race to grab share of the US sports betting market is unsustainable and will end in companies failing, according to the new chief executive of FanDuel.

Amy Howe, who was appointed head of the fantasy sports and betting company on Monday, told the Financial Times that “ultimately this market is going to settle out with three, four, five competitors. There are too many competitors right now to sustain this level of spend.”

Since a federal ban on sports betting was lifted by the Supreme Court in 2018, US and overseas companies have spent large sums on marketing to win part of what could become the world’s largest regulated gambling market.

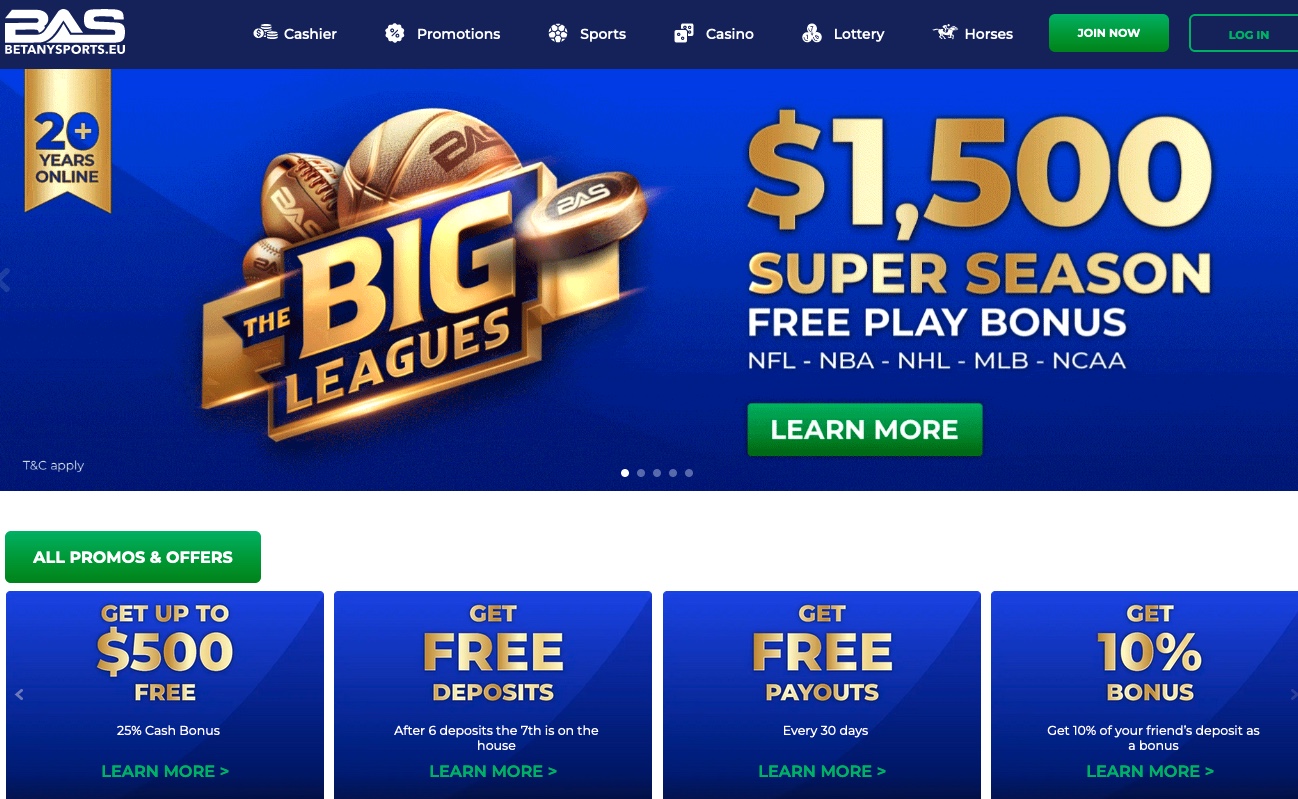

The competition to attract and keep new sports betting customers has resulted in businesses pouring millions of dollars into promotional bonuses, offers and advertising campaigns, particularly around major sports events such as the recent launch of the NFL season.

In Arizona, which last month became the latest state to legalise sports betting, seven companies have already launched gambling operations with a further eight expected to offer sports betting there by the end of the year. Since 2018, sports wagering has been made legal in 23 states.

FanDuel, which is owned by Dublin-based Flutter Entertainment, spent £225m on marketing in the first half of this year and said that, since its takeover by Flutter in 2018, it had benefited from more than $1bn of marketing investment.

Flutter has said it expects FanDuel to be profitable in 2023, depending on the speed at which states regulate sports betting, and that it expects the market for its brands to exceed $20bn in revenues by 2025.

Its rival DraftKings, another fantasy sports company that pivoted to gambling in 2018, spent $495m on sales and marketing in 2020 from $614.5m in revenue.

In most states where sports betting has been legalised, FanDuel tends to lead the market, with DraftKings coming a close second. BetMGM, the joint venture between the US casino group MGM and UK-listed gambling company Entain, is increasingly challenging for second place in terms of market share.

Last month DraftKings made a £18.4bn bid for Entain. It has until October 19 to make a firm offer.

Howe said FanDuel, which had about 1.5m active users in the past quarter, had a “very clear scale advantage” and benefited from the assets and expertise of Flutter, which owns the UK sports betting brands Paddy Power and SkyBet as well as the online poker business PokerStars.

She added that the company was on track to achieve between $1.8bn and $2bn in revenues by the end of this year “which would put us about 50 per cent ahead of the field”.

Howe joined FanDuel as president in charge of “core commercial functions” in February from the ticketing website Ticketmaster where she was chief operating officer. She said she led Ticketmaster from being “paper based to digital” and positioned it for “explosive growth”.

She was appointed interim chief executive of FanDuel in July after the unexpected departure of its previous boss Matt King, who has subsequently joined the sports merchandise company Fanatics, according to The New York Post.

Analysts at the investment bank Davy said Howe’s “previous track record scaling digital businesses and her apparent leadership skillset suggest she may always have been viewed as a potential future leader of the business”.

This article is a reprint from FT.com. To view the original story, share and comment, click here.