It’s official: America is bonkers over sports betting. Each time a new state passes a bill to make gambling on sports legal or changes a law to allow more competition among betting platforms, known as sportsbooks, it becomes ground zero in a battle between market leaders DraftKings and FanDuel, whose efforts to beat back rivals often resemble a game of Whac-a-Mole.

Take Illinois, whose most recent $483.5 million monthly “handle” (the total amount wagered on sports) and $42.2 million in gross revenue from sportsbook operators make it the fourth-largest sports betting market by revenue behind Pennsylvania, New Jersey and No. 1 Nevada. All told, Americans placed nearly $35 billion on sports bets in 2020.

With casinos facing ongoing closures due to the COVID-19 pandemic, Illinois Governor J.B. Pritzker has repeatedly suspended a law requiring bettors to register in person at a casino before they can place wagers online with their mobile devices. That ruling has opened the door for DraftKings and FanDuel, which dominate the online market, to narrow the gap with BetRivers, the first mobile sports betting app to go live in Illinois when the state legalized betting last March. U.K.-based Willam Hill and Australian firm PointsBet have been expanding in the U.S. and launched in Illinois in September. PointsBet is now blanketing the airwaves in major media markets including Chicago, a sure sign of more ad wars to come.

Similar stories are playing out across the country. DraftKings and FanDuel are the most widely recognized sportsbook names and together comprise roughly 80% of the U.S. market. But scores of competitors are now angling for a piece of the action in a torrid sports betting category that could outgrow sales of alcohol and all legal cannabis, reaching as high as $20 billion annually in the U.S., according to some Wall Street estimates.

Big bets

But brands and agencies drawn to this huge opportunity should be forewarned: Sports betting is not an easy business to break into—or break through. DraftKings and FanDuel are both owned by large public companies with deep pockets to spend on marketing, and both have vast legal and compliance teams to help navigate a patchwork of complex regulations that vary from state to state. Startup costs are steep, and in a category where most betting platforms offer essentially the same service, brands may have trouble separating themselves from the pack.

“Brands are fighting this long hard battle for market share, rising customer acquisition costs and getting high churn rates,” says Dave Edwards, exec VP of global business development at R3 Worldwide. “It’s hard for these sportsbook companies to differentiate themselves. Legally they’re really all the same, all regulated by the state and licensed.”

Agencies, meanwhile, must be able to work quickly in the legal sports-betting marketplace, where rules can change on a dime. Both DraftKings and FanDuel keep the majority of creative duties in-house (Horizon handles media buying for FanDuel) because they say it allows them to respond more quickly and efficiently to rapidly changing conditions in any given market.

“Each state is a market unto itself, and there isn’t just regulatory complexity but marketing complexity,” says FanDuel Chief Marketing Officer Mike Raffensperger. “As we think about media markets, promotions and local influencers, it is a question of where are the places we can leverage our assets at scale, and how do you put the right people and resources in place?” The company appears to be finding the right mix. Says Raffensperger, “In every state where we’ve launched, the opportunity has exceeded our expectations.”

FanDuel this week bolstered its marketing bench, announcing the hire of former Priceline and Anheuser-Busch marketer Andrew Sneyd as its new brand senior VP, overseeing creative and brand strategy, consumer insight, product marketing, team and league marketing, press relations, integrated campaigning and creative operations.

Cannabis, redux?

The rise of legalized sports betting in the U.S. resembles that of another controversial product—cannabis. The Supreme Court overturned a federal ban on sports betting in 2018. Today, the practice is legal in about half the country (compared with more than two-thirds, or 36 states, for legal marijuana). Legal sports betting is operational in 19 states, plus Washington, D.C., and six more states have either passed bills or are debating new legislation. A few states only allow in-person betting, which is important since about 90% of all sports betting revenue comes from online sources versus casinos and other land-based retail outlets, according to Raffensperger.

As with cannabis, there are no national advertising standards for sports betting companies or federal agencies in charge of monitoring their marketing activities (unlike pharmaceutical and credit card ads, which are regulated by the FTC). All sports betting practices, including marketing and advertising, are regulated by the individual gaming commissions in each state.

Every gaming commission publishes guidelines on how to adhere to responsible gaming messages in advertising and promotions. Most commissions place restrictions on the types of bets and which sports or teams players can bet on, frequently banning betting on college and youth sports. Many require sportsbooks to establish a voluntary “self-exclusion” program for players to avoid overuse of the platform. All forbid targeting ads to problem gamblers and marketing to under-age individuals (either under 18 or 21, depending on the state).

Beyond that, it falls on individual companies to decide how aggressively to pursue new customers. “The instinct for most businesses in a highly regulated category like sports betting or cannabis is to play it safe from an advertising and brand point of view,” says Anomaly founder Jason DeLand, who co-founded the cannabis company and wellness brand Dosist, and a founding partner at Anomaly, which held the William Hill sports betting account in 2019.

“Lawyers look at everything in these categories,” says DeLand. “The advice I give to agencies is that the most important document you will look at is a regulatory one—that is a major part of the brief. Then it’s the responsibility of strategy and creativity to figure out the best way to narrate your offer, your brand and your product that is just on the [right] side of those regulations.”

Where to draw the line

There is a growing debate over whether sports betting ads mislead players into thinking they’ve got a better shot at winning than they actually do. “There are a lot of offers out there and a lot of focus on becoming a millionaire—that's not the typical experience,” says Raffensperger, in what would appear to be a not-so-subtle jab at his chief rival. DraftKings recently gave away a $1 million cash prize in a National Football League-themed sweepstakes and ran TV spots urging customers to “join the over 140 players who have already cashed in a million bucks.” Other DraftKings spots place more emphasis on the thrill of having skin in the game, though each ends with the now familiar tagline, “Make it rain.”

Just how far a sports-betting company can go in its marketing remains a gray area. Some gaming commission rules, such as the placement and wording of gambling disclaimers in ads, are quite explicit. Others, namely making “reasonable” claims in advertising, are broad and open to interpretation. “The ink is still wet on a lot of these regulations and it can be a little unclear where the line gets drawn on what you can and cannot say,” notes DeLand.

When it comes to under-age marketing, that line is fairly obvious—or should be. Just ask Penn National Gaming, owner of the sportsbook Barstool Sports, which was forced to remove a social media post involving a photoshopped image of a child.

In order to place a bet with a major online sportsbook like DraftKings or FanDuel, players must create an account with a credit card or present ID at a casino that is “tethered” to the platform through an app or the web. Digital age-gating can be helpful for sports-betting brands on social media. A user’s Instagram account, for example, must be age-verified in order to access betting odds from a major sportsbook like DraftKings or FanDuel.

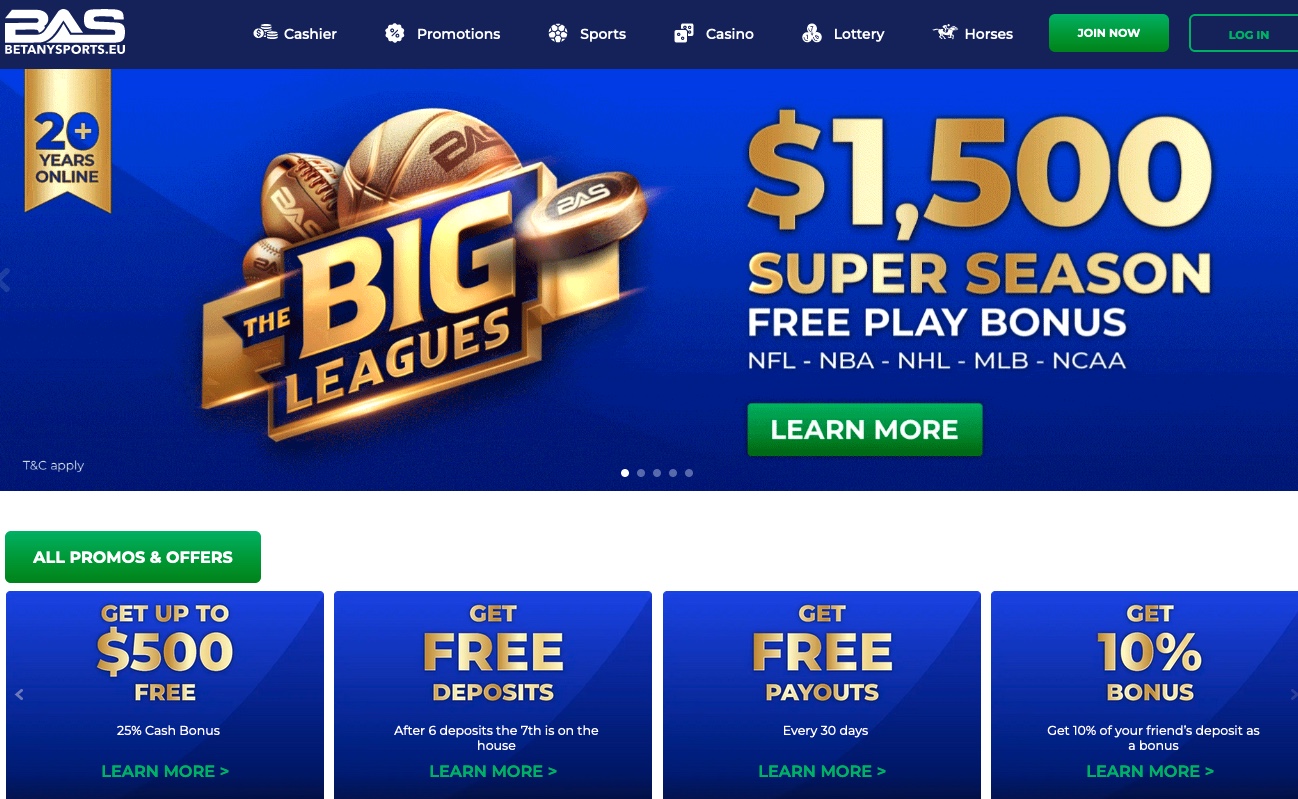

Illegally placed sports bets remain ubiquitous, just as black market sales continue to dwarf the legal cannabis category. However, establishing credit can immediately distinguish a legitimate sportsbook from an illegal offshore account, says James Santore, director of brand strategy at investment firm SeventySix Capital. “With offshore bookies, a lot of people are putting up money they don’t have,” he says. “That doesn’t happen with regulated sportsbooks. You have to have the money up front and deposit it in your account.”

Ripe for disruption

When the U.S. entered the $150 billion global sports betting industry following the Supreme Court decision in 2018, DraftKings and FanDuel had a major leg up in the category. “They each had something like a million people in their [daily fantasy sports] databases who had shown themselves willing to place money on the outcome of sports,” says Brad Allen, who covers the sports betting industry for Legal Sports Report. Fantasy sports, a category that dates back decades in the U.S., are viewed as a game of skill versus chance in the eyes of the law. Currently fantasy sports platforms are legal and available in 43 U.S. states.

Stephanie Sherman, VP of marketing at DraftKings, says that the company’s heritage in technology and data-driven marketing will drive loyalty with customers over the long term. “We’re a company built by and for sports fans,” she says, referring to her former Vistaprint colleagues and DraftKings founders Jason Robins, Matthew Kalish and Paul Liberman. “We pride ourselves on having a deep understanding of our players through product feedback, as well as on our knowledge and ability to cater to the American sports fan.”

Sports betting in the U.S. is still in its infancy, and some think the marketplace is ripe for disruption. “There are so many opportunities for newer and smaller companies to change the face of the game,” says Santore, whose firm advises tech startups that focus on sports betting and e-sports. One of those companies, Vigtory, has stirred controversy by offering to take a substantially lower “vig” (gambling slang for the cut the house takes on a bet, also known as the “juice”) in order to attract more frequent betters and high rollers.

Harry Lang, a sports and online gaming marketer based in the U.K., calls this tactic “a race to the bottom.” He warns, “The smaller guys will find it hard to compete because they won’t be able to ‘loss lead’ with small margins. They’ll go broke trying to keep up.” In regions like the U.K., where sports betting has been legal for many years, operators now face tighter government controls, including strict limits on advertising. Some may view Google’s recent move to limit alcohol and gambling ads on YouTube as a warning sign for the U.S. All the more reason to crack down on questionable practices that may “tarnish the entire betting industry,” says Lang.

Mega deals in media and sponsorships

The next growth phase for the sports betting industry may be fueled by new mega deals in media, advertising and sponsorships. A huge push into sports betting by broadcast and cable networks over the past 18 months included a major deal by CBS to make William Hill its official sportsbook sponsor; NBCUniversal’s 5% stake in PointsBet, estimated at $500 million; and Fox Sports’ $236 million investment in its own branded sportsbook, FoxBet.

“The amount of dollars that are available in the sports betting marketplace is growing exponentially. This is just the tip of the iceberg,” says Derek Van Nostran, chief marketing officer of VSiN, the 24/7 sports betting cable network started by family members of former sports broadcaster Brent Musburger. “Eventually things will shake out and there will be clear winners in the space, but right now it’s a pure land grab and eyeball grab.”

VSiN, which portrays itself as “the CNBC of sports betting,” broadcasts a variety of informational programming and sells advertising to both sportsbooks and traditional brands. While the network does not share ratings data, Nostran says, “In terms of usage and subscribers, everything is up at least 100% year over year. We expect the momentum to continue as sports betting provides a whole new layer to the sports viewing experience.”

Many executives in the TV sports world are banking on that enhanced viewing experience to bring back viewers in a post-pandemic ad environment, following a year in which ratings for the major leagues dropped by 30% or more. DraftKings and FanDuel are both developing integration plans to leverage new multi-year partnerships with Turner Sports. “We’re looking for a handful of deeper partners in nine to ten key categories, mostly around the NBA. We’re getting a lot of active interest,” says Raffensperger. The company also hopes to build on its recent branded integration with the Denver Broncos and Bud Light.

DraftKings is looking to extend its fantasy sports partnership with Buffalo Wild Wings into sports betting, and hopes to include brands in a number of consumer categories, says Sherman. “Sports and sports betting intersect with so many daily activities. The opportunities for integration are endless.”

To those who pigeonhole the sports betting arena as relevant only for marketers of products like cars or beer, Raffensperger has a reply: “We’ve got over 11 million registered users who are highly engaged young men with high household incomes. It is one of the most sought-after but difficult to reach demographics on the internet and on all of the television landscape.”

But don’t ask him to name his dream partner or even the most fertile category. “That’s like asking me to name my favorite child,” he says.

This article is a reprint from AdAge.com. To view the original story and comment, click here.