Earlier this summer, with the global sports schedule sidelined by a once-in-a-century pandemic, Barstool Sports founder Dave Portnoy occupied his time by day trading on a live webcam in front of thousands of loyal Stoolies.

Swinging a heavy green mallet above his head, Portnoy did his best Carlton Fisk impression, imploring shares of Penn National Gaming to move higher. As the seconds ticked down toward market close, Portnoy reached down to his smartphone and began to blare the 1983 hit “Sweet Dreams” by the British duo Eurythmics. Unlike most founders of major companies valued at $450 million, Portnoy traded on a June afternoon in garb fit for a frat boy — wearing a personalized Boston Celtics jersey and a white cap adorned with a DDTG logo, short for his self-proclaimed stock picking service — Davey Day Trader Global.

“You’re at $29.87, get over!” Portnoy exclaimed. “I’ve got the Green Hammer of Death, stocks only go up when I pick this thing up! I’m up 20 grand on the day — 22 grand!”

Then, suddenly, Portnoy fell to the floor, after thumping his logo with the massive hammer.

“Owwww, I just cracked my head,” Portnoy said. “This is like an industrial hammer. I think I’m concussed! You gotta play hurt, the suits wouldn’t be playing right now! I gotta trade.”

Minutes later, after Portnoy returned to his black leather chair, he glanced at his trading screen and noticed that Penn National had rallied above $30.

“They actually made a comeback when I was dead! It’s over $30 … if I have to knock myself unconscious on the ground and bleed to get Penn to the moon, I will do it!”

Now, as one of the strangest NFL seasons in league history kicks off, Penn National is betting big on Portnoy. On Tuesday, Penn National announced plans to launch the Barstool Sportsbook app on Sept. 18, following a Pennsylvania state-monitored test period from Sept. 15-17. The mobile sports betting app, which Penn National CEO Jay Snowden describes as the centerpiece of the company’s omni-channel strategy, has arguably received more fanfare than any sports gaming product since the Supreme Court’s historic 2018 PASPA decision. Will the Barstool app catapult Penn into the same online betting stratosphere as industry heavyweights DraftKings and FanDuel? Or, will the app fail to live up to its considerable hype?

“You (only) get one chance to make a first impression,” Snowden said in August during the company’s second-quarter earnings conference call.

An industry game changer?

Penn National traded above $57 on Tuesday, at one point rising more than 5% on news of the imminent Barstool launch. Shares of Penn National have rebounded sharply from mid-March levels when the COVID-19 pandemic triggered a global sports freeze. On March 18, shares of Penn National hit a nadir, sinking to $3.75 in midday trading, down from pre-COVID levels near $40 a share in late February.

When Penn National completed its acquisition of a 36% interest in Barstool Sports on Feb. 20, the company traded at a session-high of $39.18, the highest in a year, and an increase of about 53% from its closing price on Dec. 31. As casinos nationwide began to reopen this spring, several top professional sports leagues took steps to resume play, providing two sources of Penn National’s upward trajectory.

Snowden gushed about the Barstool partnership, calling the media company an amalgamation of “SportsCenter, Howard Stern and Reality TV” during July’s SBC Digital North America Summit.

Penn National closed on Wednesday at $58 a share, trading above $50 for the 20th consecutive session. In August, shares of Penn National surged more than 50%, ending the month above $51 a share.

In recent months, regional gaming operators such as Penn have traded at an EBITDA (Earnings before interest, taxes, depreciation, and amortization) multiple of 7x to 8x, according to Chad Beynon, a senior equity research associate at Macquarie Group. By comparison, DraftKings projected a 2020 EBITDA multiple of 9.9x last December when the company announced a unique tri-merger with Diamond Eagle Acquisition Corp. and SBTech. Typically, companies with an Enterprise Value/EBITDA multiple below 10x are viewed as healthy investments by analysts.

With Penn at $55, Macquarie pegs the value of the Barstool app and its retail sportsbooks at $20 to $25 a share. The estimate assumes that Barstool will achieve a sports betting market share in the range of 9% to 12%. In the event that Barstool carves out a market share of 15%, Macquarie believes that Penn’s iGaming/Sports betting business would be worth $40 a share, Beynon told Sports Handle.

Other analysts are even more bullish on Barstool. Craig-Hallum analyst Ryan Sigdahl initiated coverage on Penn in early September with a $75 price target. While the Barstool app should be viewed as a positive development for Penn, the launch has been hyped to the point that it probably won’t be “a huge catalyst” for shares immediately, Sigdahl told Sports Handle. Over the next several years, however, Sigdahl believes Penn has the ability to eclipse $200 a share.

Sigdahl’s optimism is based partly on Portnoy’s immense popularity among a key 21-to 44-year-old demographic, who have shown an affinity for sports betting. Barstool boasts average site traffic of 66 million monthly unique visitors, known commonly as Stoolies, an estimated 62% of whom already bet on sports. When Snowden was asked on the earnings call if the figure on monthly unique visitors is outdated, he replied it is the metric Penn Nation will continue to cite for gauging Barstool’s user engagement. Nevertheless, Portnoy routinely drew six-figure audiences for his stock trading escapades; the video where he donked himself on the forehead received more than 243,000 views on Twitter.

“If millions of people follow his pizza reviews and stock trading, how many do you think will follow his sports betting recommendations?” Sigdahl wrote in an analyst note. “We think a lot.”

Though Barstool’s reach is unquestioned, analysts will monitor whether the company can convert thousands of loyal Stoolies from the current industry-leading platforms, most notably DraftKings. When Portnoy, Snowden, and Barstool Sports CEO Erika Nardini appeared on the CNBC program Mad Money in June, Penn National had a valuation of around $4 billion. Riding the momentum of its public market debut weeks earlier, DraftKings boasted a valuation at the time in excess of $13 billion. In touting Barstool’s unique customer base, Nardini confidently asserted that the figures should be reversed.

Hours before the NFL opener between the Kansas City Chiefs and the Houston Texans, Penn soared more than 10% on Thursday to $65.79 a share, reaching a 52-week high. Penn National’s valuation eclipsed $9 billion in Thursday’s session.

Reputational harm

Barstool has not become one of the top websites for sports and entertainment without a fair share of controversy. In the wake of Tom Brady’s four-game suspension for his role in the 2015 Deflategate scandal, Portnoy was arrested after he handcuffed himself to a desk inside the lobby of NFL headquarters to protest the decision. Portnoy, nicknamed “El Presidente,” also received criticism in 2016 when he joked that Colin Kaepernick bared resemblance to a member of ISIS.

More recently, Barstool garnered controversy for using a racial epithet in the title of a podcast featuring two African-American hosts — Brandon Newman and former NFL offensive lineman Willie Colon. Without addressing the incident specifically, Snowden said on the call that Barstool’s brand of humor is irreverent and often satirical, while admitting that “not everyone loves it.” Although Nardini indicated at July’s SBC digital summit that the episode was not one of her favorites, she emphasized that Barstool supported its content creators’ freedom of expression.

“We believe the company’s management and board appropriately assessed their exposure to reputational risk,” Barclays analyst Felicia Hendrix wrote in a research note. “As a regulated company in a highly regulated industry, we are confident that Penn has taken the right steps to ensure that this partnership is aligned with company and regulatory standards.”

Unique betting experiences with El Presidente

Snowden noted on the second-quarter call that Barstool plans to integrate offerings into the app that will allow users to bet against Portnoy and other popular Barstool figures such as Dan “Big Cat” Katz, Brandon Walker, and Matt Cahill, more commonly known as “Marty Mush.” Penn has not disclosed if Portnoy will stake his own money or if he will enter into head-to-head contests with users through an exchange wagering format. It is more likely that Barstool bettors will be able to track their wagering history versus Portnoy over an extended period of time, such as the entirety of the NFL regular season.

A number of books have attempted to spice up the betting experience for customers through contests with celebrities. Last weekend, DraftKings hosted a props contest for select media members against former NBA power forward Carlos Boozer. FOX Bet, meanwhile, routinely offers custom bets from personalities such as Colin Cowherd. During the 2019 NCAA Tournament, another FOX Bet host, Cousin Sal Iacono, gave fans an opportunity to win his Los Angeles-area home if a shrewd bettor filled out a perfect bracket (estimated odds of 1 in 9.22 quintillion).

The odds of defeating Portnoy head-to-head are decidedly lower.

App technology

The allure of testing one’s gambling prowess against Portnoy may move the needle for some, but there are numerous other factors that could have a larger impact on the Barstool app’s long-term success. A key determinant, according to Amir Ghodrati, director of market insights at the mobile data and app analytics company App Annie, will be whether Barstool can retain customers by creating a memorable, entertaining experience through the app.

“The most important thing to do when launching an app is to ensure people enjoy the experience and want to keep coming back for more,” Ghodrati told Sports Handle via email. “Creative marketing campaigns or a well-known brand name can kickstart downloads, but it’s going to become costly if you can’t retain users.”

Both Penn National and Barstool have remained tight-lipped on the app’s design. Even so, it is clear that the companies have invested a considerable amount of time and financial resources in the product. In early February, Snowden disclosed that the company enlisted a team of more than 50 product developers and engineers with goals of creating a best-in-class app. Earlier this year, Penn Interactive Ventures listed an opening for a full-time senior Android engineer with a starting annual salary of $120,000 to $135,000.

The Senior Android Engineer works in conjunction with the Android Technical Lead in a small, cross-functional team to develop a one-of-a-kind, native sports betting experience. Candidates for this role will work with one of the most successful UI/UX firms in the country to implement a revolutionary sportsbook from the ground up. — Penn Interactive job listing.

The responsibilities for the successful candidate included collaboration with “ops engineers, QA engineers and various other teams to solve innovative problems” and to “squash bugs,” in order to ensure an “unrivaled” user experience. The priority given to building an app with top-notch under-the-hood technology suggests that Barstool is aiming to avoid the kind of costly glitches that affected a host of sportsbooks during the last few months. Several books have experienced unplanned outages over the last year, including one suffered by FanDuel on the first weekend of the NFL Playoffs.

In order to limit the risk of tech malfunctions, top sportsbook apps need to have a sophisticated infrastructure capable of handling the bandwidth from a large number of betting transactions, a gambling technology expert told Sports Handle.

When Penn National unveiled a groundbreaking market access deal in July 2019, the company designated Kambi Group plc as its national provider for Penn Interactive’s sports betting trading services. Kambi, which has received high marks for its open API (application programming interface) access, has developed a price differentiation tool for sportsbook customers. The tool will give Barstool the option of adjusting odds for pre-game and in-game markets, rather than using the conventional line. For instance, in Pennsylvania the platform would enable Barstool to increase the line in a Week 2 matchup between the Philadelphia Eagles (-4.5) and Los Angeles Rams if there is a heavy regional bias on the hometown Eagles. Kambi clients also have the ability to adjust the margin applied for various lines, as well as the pricing for in-game odds, depending on how they want to compete with the market on pricing.

At first, the Barstool app will be available in Pennsylvania only, before Penn National expands to several other states in the coming months. At present, Pennsylvania is a particularly heavy Kambi market, with five of the state’s nine active online operators using Kambi’s technology to power their sportsbooks. That includes DraftKings’ sportsbook app, which at some point in mid-late 2021 is expected to shift over to a platform by its new in-house platform provider, SB Tech.

Penn National has also partnered with European-based White Hat Gaming to provide PAM (player account management) solutions for the Barstool app. White Hat, which powers dozens of brands in Europe, won a bid to become Penn National’s online PAM provider after a competitive selection process. A robust platform is essential for safeguarding the personal data of thousands of bettors.

A White Hat spokesperson did not respond to a request for comment.

Cause for concern

While several Wall Street analysts have assigned a buy rating to Penn National, one analyst has taken a contrarian viewpoint on the stock. Carlo Santarelli, managing director at Deutsche Bank Securities, questions whether Penn National offers the same “value proposition” as the leading sports betting companies in the space. Two operators in particular, DraftKings and FanDuel, appear willing to lose money in order to acquire and retain customers, which historically has not been a hallmark of Penn National’s strategy, Santarelli explained.

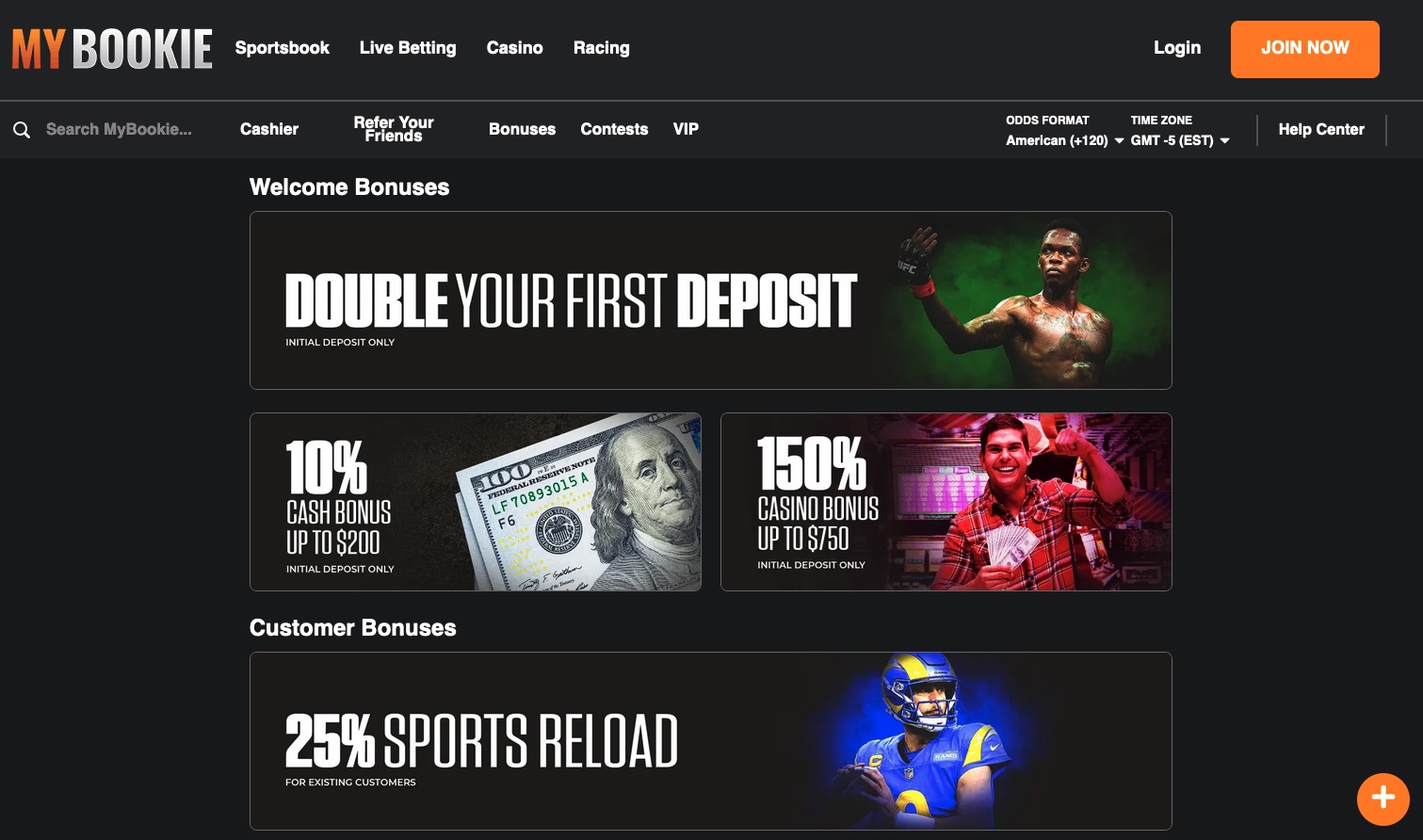

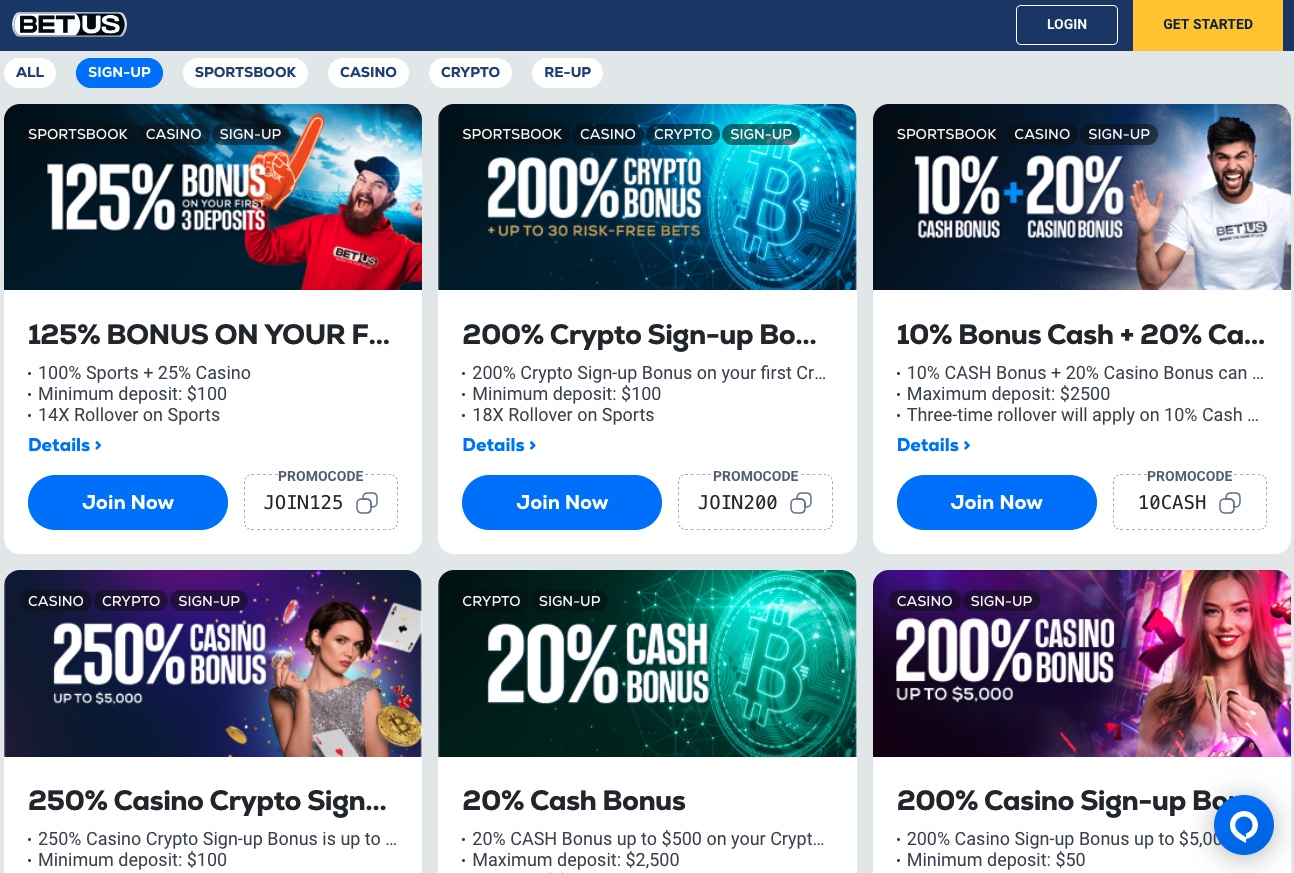

The two DFS giants, along with other top books such as BetMGM, PointsBet USA, and William Hill U.S., have spent millions in recent months on promotions in an effort to entice customers. It remains unclear to what extent Barstool plans to utilize boosted bets and other promotions that became en vogue over the summer during the return of sports. As of June 30, Penn National had total traditional debt of $3.12 billion, up nearly 32% over the previous six months. Ostensibly, if Penn is forced to service a considerable amount of debt (through rent and interest payments) in the near-term, the company may have less to spend on sports betting marketing and promotions. Penn National had $1.24 billion of cash on hand at the end of its second quarter.

Santarelli anticipates that regional gaming operators in 2021 will have a hard time returning to 2019 EBITDA levels, exerting additional pressure on them from a “balance sheet perspective.” Another analyst, Truist Security’s Barry Jonas, believes Penn National is relatively well-positioned during the COVID-19 recovery phase, as company management has taken steps to address balance sheet concerns.

Penn National operates physical casinos in nearly a dozen states with legalized sports gambling, the majority of which also allow online sports betting.

With Barstool’s user engagement projected to increase 40% year-over-year, there is a stronger likelihood that Penn National will eventually hit Morgan Stanley’s target of a 10% sports betting/iGaming market share, analyst Thomas Allen wrote in a research note. Under Allen’s bull case, Penn National will average 2021/2022 adjusted EBITDAR of $1.8B, while trading at $84 a share.

Despite the hoopla surrounding the Barstool app, it is still difficult to predict whether Penn Interactive will attain Top 3 status in terms of sports betting market share by 2025.

Nardini is embracing the underdog role.

“Penn is an underdog company and I think Barstool is an underdog too,” Nardini said at the SBC Digital Summit. “Barstool Sports has gotten to where we are by virtue of our own grit, our smarts, being hungry, trying things, failing, getting up, and trying them again. In large part, Penn has done the same thing. It’s a self-made company.”

This article is a reprint from SportsHandle.com. To view the original story and comment, click here.