Since the adoption of The Gambling Act 2005, there haven’t been any significant changes in the UK legislation regarding gambling. Yet, beginning in 2019, a tangible move towards over-regulating the market began with the introduction of fixed-odds betting terminal (FOBT) limits.

During the last two decades, the market was flooded with online gambling operators. The abundance of casino platforms offers a great advantage to gambling enthusiasts because they can choose one that fits their needs.

Online casinos make it easier to enjoy your favorite slots or table games because all you need is a device that can connect to the Internet. However, choosing the right platform can be a daunting task because you can’t be sure that you picked correctly unless you’ve done extensive research first. At the same time, there have been various calls for additional regulation and imposing a £2 betting limit on online slots as well as restricting VIP programs and advertisement.

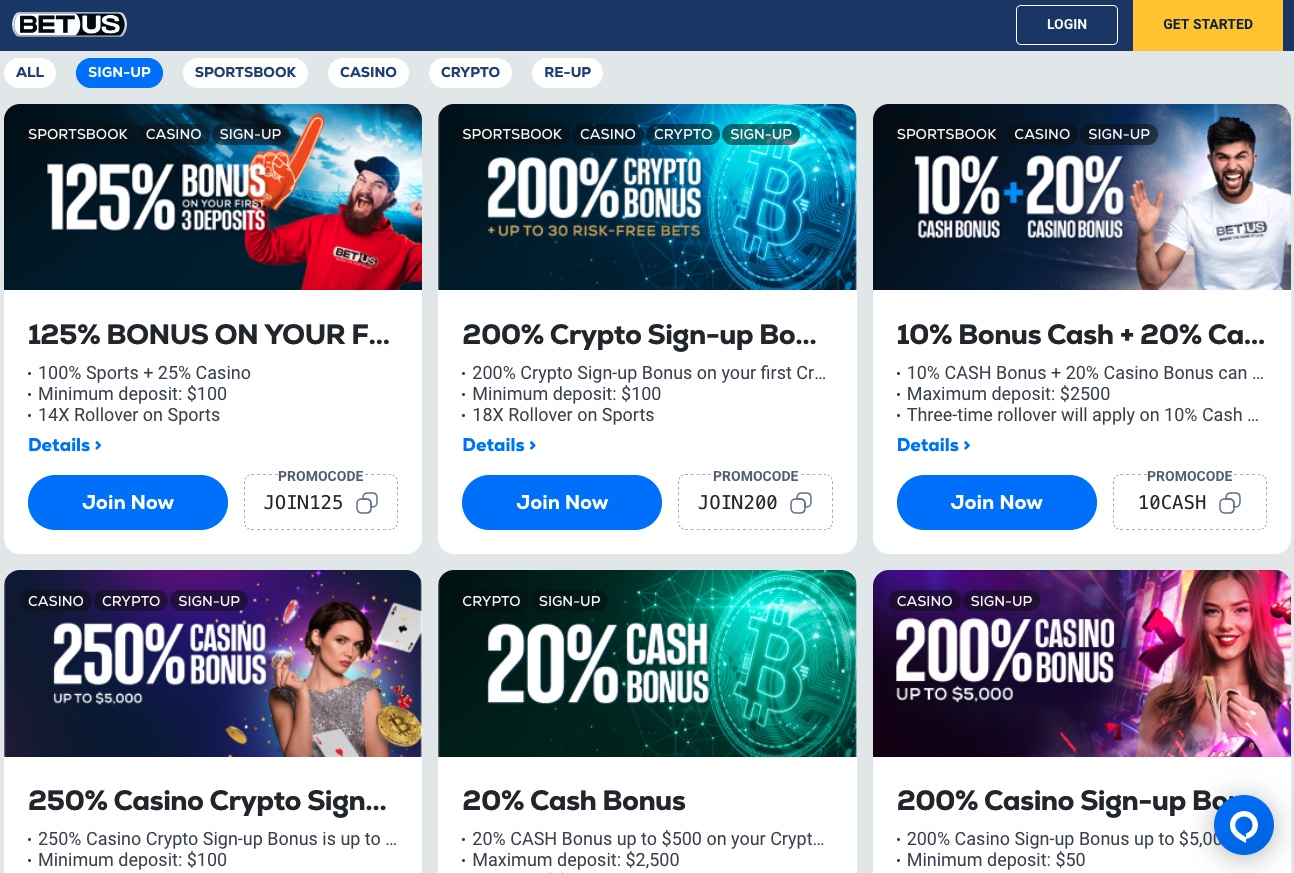

Rushed changes in regulation could affect the user experience, and create abundant and unwanted opportunities for offshore operators to tempt UK players into signing up for an offer that isn’t approved by the Commission. To avoid this, all changes can be referenced at bonus aggregating services that properly reflect the terms and conditions as required by law.

The UK government has acknowledged that legal and regulatory problems might arise due to the quick expansion of the online gambling industry. For that reason, they passed the 2005 Gambling Act hoping that it will solve those issues. However, the Act wasn’t enough to prevent illegal gambling activity, so the government created the UKGC, which has the responsibility to ensure that casino operators respect the laws and regulations stated in the Gambling Act.

Recently, there have been discussions regarding some modifications in the rules imposed by the UK Gambling Commission that affect online gaming providers and bookies. Here’s what was posted on the official Gambling Commission Twitter account:

The UK Gambling Commission stated that Britain’s betting industry is getting out of control, and cross-party consensus for a new Gambling Acts has already been discussed. Let’s have a look at what major changes were made in the legislation are and how they will impact the gambling market in the UK.

New Solutions for Underage Gambling

According to statistics from the UKGC, up to 450,000 children between ages 11 and 16 bet regularly. To prevent underage gamblers from cheating the system and start playing casino games before the legal age, the Commission has instructed online casinos to manually verify the age of their customers by asking them to provide some form of identification that will be checked by a compliance team.

This solution is ideal for the underage gambling problem because platforms are restricted from accepting payments from cards that aren’t on the same name as the account. On top of that, the amount of time it takes for the identity of an individual to be verified by the gambling operator has been drastically reduced to handle the increasing amount of requests that they are receiving.

Credit Card Payments Are Restricted

Earlier this year, the Gambling Commission made a public announcement that making deposits at an online casino using a credit card is officially illegal in the UK. This decision was taken after the results from a survey conducted by the UKGC showed that nearly 22% of all the British gamblers were using their credit card to fund their accounts were classified as problem gamblers. Additional research showed that there was an increasing number of people that were getting into tremendous debt because they were making deposits with their credit card.

While these new regulations might be infuriating for some of the gamblers out there, it is an efficient way to prevent massive debt and people losing their belongings, hoping they would recover the money that they borrowed for gambling by winning in the casino.

PayPal and other popular e-wallet providers announced that they would contact their users to make sure they are aware of the new legislation that was put in place, and those that had credit cards linked to their account should add a valid debit card instead.

Bookmakers and online casinos weren’t happy with those changes, because their profits dropped significantly. However, the Gambling Commission denied their requests, stating that their top priority at the moment is providing the best balance protection to the consumers. The new regulation regarding credit card payments came into effect on 14th April 2020. In the coming years, we will find out if it changed anything regarding problem gamblers.

New Regulations Keep Churning in the UK

The regulatory changes we’ve discussed in this article are huge, so we expect that it will take some time until online casino operators adapt to them and ensure that they are compliant with each one of them.

Therefore, it is likely that the Gambling Commission will wait a few years to see how effective those changes are and if their decisions will impact the number of gambling addicts. However, it is speculated that they are working on a new Gambling Act that should cover “new-age technologies,” which will regulate the mobile casino market and other emerging technologies that could be used for gambling activities.

This article is a reprint from GamblingNews.com. To view the original story and comment, click here.