Online sportsbooks bid for NY licenses amid tax and profitability questions

When New York announced that it was going to offer online sports betting in the state, casino and sports betting operators throughout the world began licking their chops. After all, New York is one of the biggest markets for sports betting.

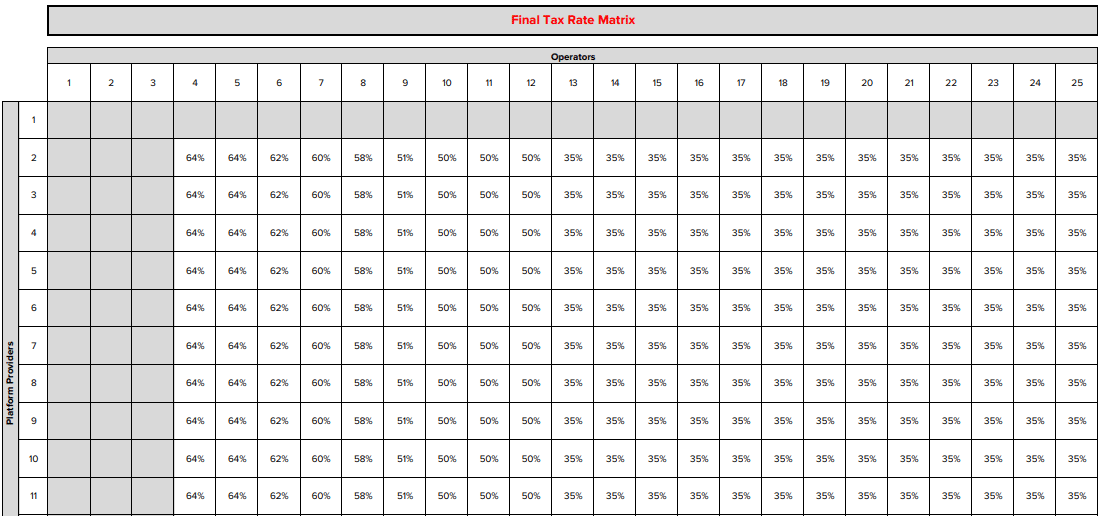

Illegal underground bookmakers are known to be abundant throughout the state, most offshore sportsbook operators have indicated that New York residents make up a large percentage of their client base, and with a population of almost 20 million people, New York is the 4th largest state in the U.S. behind only California, Texas, and Florida, three states that will not have commercial online sports betting any time soon.  The excitement was likely quelled in July when Governor Andrew Cuomo announced he wanted a minimum 50% tax rate for online sports betting and it was almost certainly quashed when the new tax matrix came out indicating a maximum tax rate of 64%. The rate does come down with subsequent operators and platform providers although what that means exactly is confusing. As it stands now there are six bids for a license, including three standalone bids by Bet365, Foxbet and TheScore. In addition, there are three super bids, with DraftKings submitting a bid on behalf of themselves; FanDuel, BetMGM and BallyBet, Kambi submitting a bit on behalf of Caesars; BetRivers, WynnBet, PointsBet and Kambi submitting another bid on behalf of BarStool Sports, Resorts World and Fanatics Sportsbook, with themselves as part of the bid.

The excitement was likely quelled in July when Governor Andrew Cuomo announced he wanted a minimum 50% tax rate for online sports betting and it was almost certainly quashed when the new tax matrix came out indicating a maximum tax rate of 64%. The rate does come down with subsequent operators and platform providers although what that means exactly is confusing. As it stands now there are six bids for a license, including three standalone bids by Bet365, Foxbet and TheScore. In addition, there are three super bids, with DraftKings submitting a bid on behalf of themselves; FanDuel, BetMGM and BallyBet, Kambi submitting a bit on behalf of Caesars; BetRivers, WynnBet, PointsBet and Kambi submitting another bid on behalf of BarStool Sports, Resorts World and Fanatics Sportsbook, with themselves as part of the bid.

New York plans to approve at least two platform operators and four platform providers, but the question many are asking is what exactly is the difference between a platform operator and a platform provider and how does that affect the tax rate? I looked at the Request for Application (RFA) released in July and according to the document, the company that is running the sportsbook, i.e., DraftKings, BetMGM, Caesars etc. are platform operators while the company that sets the lines and runs the sports betting is the provider. It is laid out in section 2.1 to 2.3 of the RFA as follows:

2.1 Mobile Sports Wagering Platform Provider

The Platform Provider is the primary Applicant in response to this RFA. If more than one Platform Provider is included within an Application, one Platform Provider must be designated as the Primary Applicant. The Primary Applicant is responsible for identifying all other Platform Providers and the Operator or Operators that will be hosted by the Platforms. They are also responsible for the submission of all information and documentation required of all Platform Providers and Operators as part of their Application. If the Applicant is awarded a Mobile Sports Wagering License, the Platform Provider will be responsible for the operation and maintenance of a Platform for the integration of Operator(s) to accept and process Mobile Sports Wagers.

2.2 Services to be Provided by a Platform Provider

The Platform offered by the Applicant must perform the following activities and services in the offering of Mobile Sports Wagering: A. fully integrate the Operator’s wagering system into the Platform; B. accept and register all wagers; C. generate all electronic wagering tickets; D. compute wagering and payoffs; E. maintain records of all wagering activities; and F. generate and/or submit to the Commission all required reports.

2.3 Services to be Provided by an Operator

The licensed Operator shall be the entity establishing Sports Wagering using the Platform. Responsibilities, duties and requirements of an Operator are defined and determined, by context, in the draft regulation Part 5330, which has been included as Appendix A: Draft Regulation Part 5330.

The RFA Also notes that the Operator is a “skin” defined in 5.330.1(12) as follows:

5.330.1(12) Skin means a mobile sports wagering operator as defined in Racing Pari-Mutuel Wagering and Breeding Law section 1367(1), that is a public-facing operator that accepts sports wagers through a platform provider.

Huh?

There you go. Clear as mud. And DraftKings said that in their bid each company listed would be both the platform operator and provider, which may go against the requirement that there is only one platform provider. In any case, looking at the betting matrix the only thing that affects the tax rate is the number of operators and those are clearly the names that will be on the betting website, i.e. BetMGM, DraftKings, Caesars Sportsbook etc.

Assemblyman Gary Paltrow indicated he would like each bid to get a license, but if that happens, there would be 17 operators, meaning a 35% tax rate, and the state already said it wants at least 50%, meaning they won’t agree to more than 12 operators. The super bids apparently were submitted to convince the state not to look beyond their bid to grant licenses, so if the DraftKings bid wins then it would result in four operators, which means a 64% tax rate. If the Kambi super bid with Caesars wins it, five operators would result in the same 64% tax rate. And if the state chooses to grant both bids a license that would result in nine operators, which means the tax rate would drop to 51%. If there are less than 10 operators, then the license is good for 10 years and if there are more than 9 operators then the rate drops below 51%, so the licenses are only good for five years. So almost certainly the state will want to stick as few licenses as possible and definitely no more than 7 licenses where they still get a 60% tax. For that reason, it’s quite possible that the state will grant a license to one of the super bids as well as one or two of the standalone bidders, most likely Bet365 which is quite prominent in neighboring states now and/or TheScore, since that company was just bought by Penn National, providing a lot more experience than FoxBet.

The one advantage to offering more than five licenses is that each winning operator must pay a $25 million license fee. So if the state licenses say 7 operators, then they get 60% tax and $175 million up front in license fees, but if they grant licenses to all 17, they get 35% tax and $425 million in license fees. Thus, the question is whether the extra $250 million up front will be better than the extra 25% in taxes over the term of the licenses. Considering some analysts are estimating that legal sports betting in the state could reach $1.7 billion in just a few years, there is no question that the tax is more meaningful than the licensing fee. So, it’s very unlikely the state will give a license to all applicants.

High Tax Rate a Concern for Bettors

The question New York bettors will be asking themselves is what the high tax means for them. Right now tax rates across the country vary greatly. Nevada and Iowa are the lowest in the country at 6.75%, Michigan is at 8.4% and Indiana is at 9.5%. All other states are over 10%. Rhode Island and Delaware charge a 50% tax rate and New Hampshire is at 51%. That said all 3 of those states with a 50% tax rate gave solo licenses to the lotteries for online sports betting and DraftKings runs the sports betting for New Hampshire. So, at 60% or more New York would have the highest tax by far.  Are the lines different in states with higher taxes than others? Not really.

Are the lines different in states with higher taxes than others? Not really.

Looking at all the states with online sports betting, the lines on NFL, NCAA football and basketball are pretty close. Almost all sports have a 20-cent line and the hold on future bets and propositions is about 30%. The difference is the number of options available. In Nevada, Iowa, Michigan, and a few other states the number of proposition bets, which tend to be riskier for the operators, are much less than in states with higher taxes. Sports like NASCAR and golf, which have a lower win percentage than the five mainstream sports of football, baseball, basketball, hockey, and soccer, tend to have much fewer betting options. The future odds are also slightly lower in the high tax states. But the real question is will that still be the same for the long term?

The long view of NY online sports betting

I spoke to Jackie, a gambling analyst who said that she believes the options and possibly the odds will have to be different in New York for the company to be profitable.

"Even at a 64% tax rate, there is still some money to be made by operators, but that will not be the case if New York refuses to allow the winning bidders to deduct all costs for promotions, client acquisition costs and similar as part of their gross profits. There could also be some extra federal or state taxes we don’t yet know about which will affect the bottom line. Currently some states will not allow promotional costs to be deducted from the winnings so the gross profit reported for tax purposes could be higher than the real profits which again makes the 64% tax unworkable. Nevertheless, the bidders in New York are strictly focused right now on winning the license and they will worry about the tax rate and other implications later. Once the operators are chosen and the tax rate is affirmed, there is no question that the odds and offerings will have to be adjusted to make it worthwhile.

That happened in the UK when sportsbooks there increased their odds on soccer and American sports ever so slightly after the UK Gaming Commission raised the tax on gross profits. It upset some of the larger bettors, although smaller bettors didn’t care or notice, since a 5-cent different in lines doesn't really affect them. The bigger concern is that if the lines aren’t competitive larger players will start looking at lines and offers in other states as well as offshore and at illegal bookmakers. If they can get 7/5 odds betting offshore, but only 5/4 odds betting in New York, then no doubt bigger players will play offshore. That may happen anyways since offshore sportsbooks and underground bookies don't report winnings to the IRS. As well, if those in New York City could get a better line or betting options they prefer by simply driving or taking public transit 30 minutes to New Jersey and placing the bet there, then they certainly will look at that too, and since New Jersey’s tax rate is only 14% it is almost certain that in some instances there will be better lines in New Jersey than in New York. It’s also quite notable that both New Jersey at 14% and Pennsylvania at 36% are raking in the bets and profits from sports betting despite the tax rate and much of that is attributed to the vast array of betting operators in those states. Limiting the number to 4 operators may actually backfire for New York.”

Asked who she believed was the frontrunner to win the bids, Jackie said it’s almost a given that DraftKings will get a license, but after that it’s uncertain.

“If they stick to those 4 operators then the state will get the maximum tax rate for 10 years, but I also wouldn’t be surprised to see Bet365 get a license as well, since they have made a big push in the state and that extra license still keeps the tax rate at 64%. DraftKings and FanDuel are the big names in sports betting across the U.S. and as part of the same bid it’s hard to see the state not giving them a license. It also must be noted that BetMGM just bought Yonkers Raceway and they wouldn’t have made that investment unless they were assured there was a sports betting and advertising opportunity at that venue. I’m a little confused how BallyBet became a part of that bid although they could provide a good opportunity to introduce virtual sports betting into the platform. I think it’s safe to say that Kambi’s bids are in trouble, and I just don’t see FoxBet or the Score being given serious consideration. In 10 years’ time if the state determines it’s worthwhile to bring them in as well then those companies can get a license then. One thing I can guarantee you though is that if I'm right and Kambi loses their bids, then New Yorkers can expect to be inundated with ads and promotions from Caesars and PointsBet to make their bets in New Jersey and get some huge incentives in return and the same thing will likely happen with BetRivers in Pennsylvania."

All bidders have until 5 p.m. ET today to resubmit their bids indicating they will adhere to the tax rate as laid out in the matrix and that they will agree to pay the maximum 64% tax should the state only license up to five operators. That demand and deadline may seem unfair, but as Jackie said, the goal now is to win the bid and worry about the specifics later, so its' almost certain every operator will adhere. The big question is whether the high tax rate will be a disincentive to bettors in the state. Only time will tell.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!