Higher state budget deficits could serve as a potential catalyst for faster regulatory approval of sports betting, and its cousin, mobile casino gambling.

State budgets were already in trouble before the pandemic hit; in the ensuing months they have been outright devastated. With shuttered businesses and tens of millions of people left unemployed, state revenues are collapsing and costs are skyrocketing. The Center on Budget and Policy Priorities estimates a $615 billion fiscal hole in state budgets as a result of Covid-19 cumulatively over the next few fiscal years.

It’s untenable. State lawmakers around the country may look to legalize sports betting as a way to raise revenue. Commercial casinos generated over $10 billion in state and local gaming tax revenue last year, and that doesn’t include sales and income tax tied to casino gaming. State governments have gotten addicted to the lucrative tax revenue from casinos; legalizing sports betting is the next logical way to get a little more juice out of the same orange.

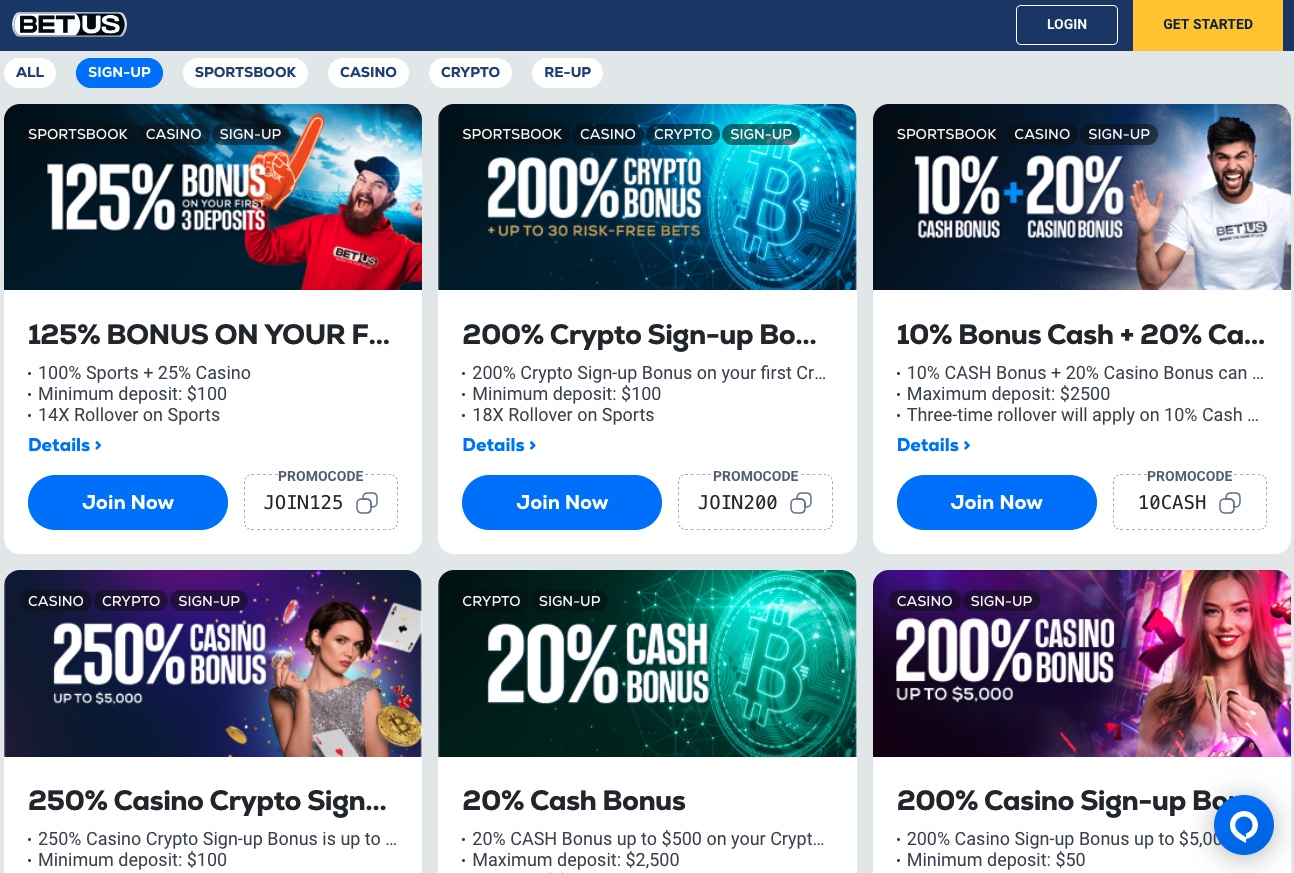

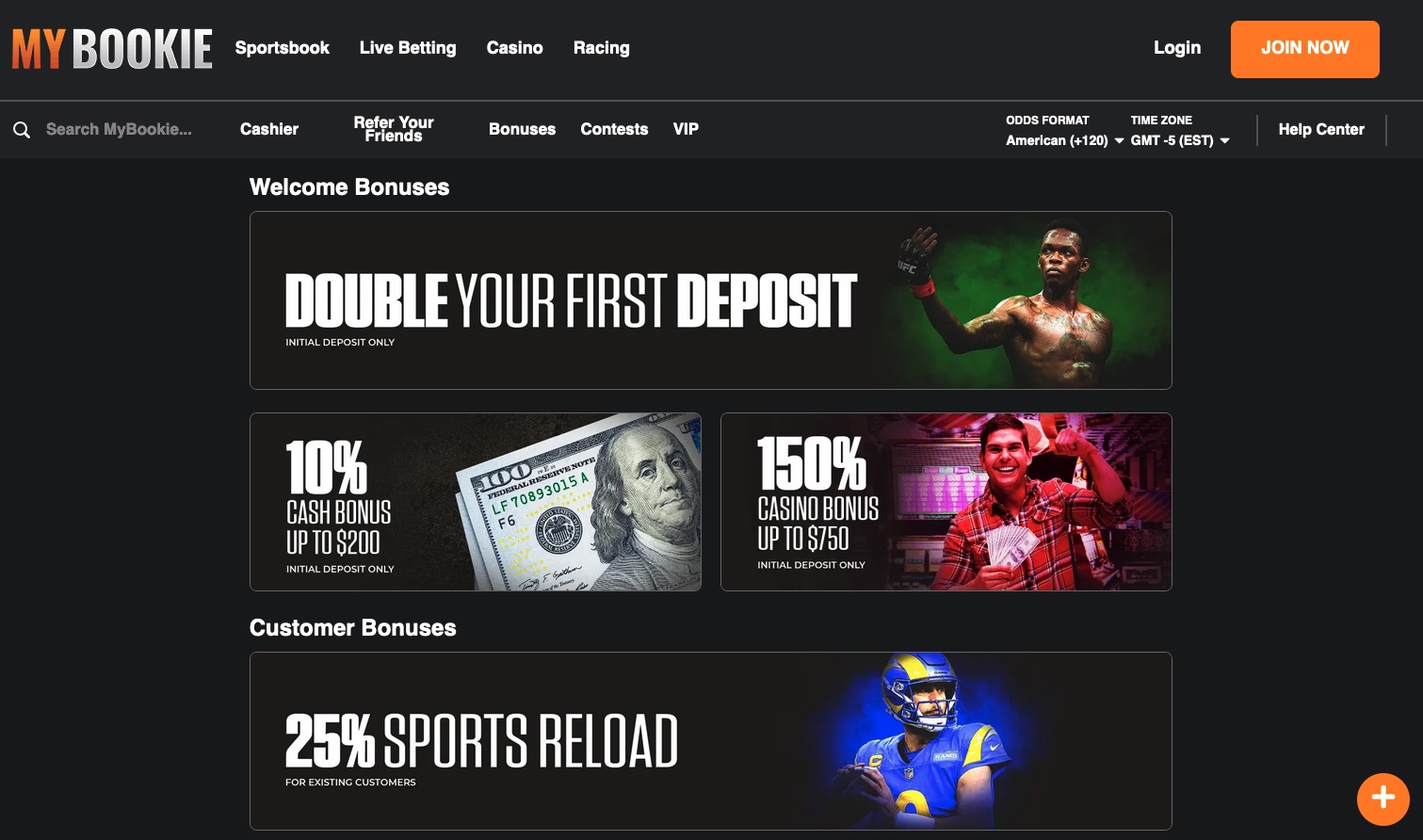

Plus, sports-betting operations can launch quickly, usually in under six months, and create tons of jobs. Mobile sportsbook apps let would-be bettors play from home when casinos are closed, and even without sports, companies like DraftKings have found things to let its customers bet on, from Korean baseball to e-sports and table tennis.

Sports betting is already legal in 18 states plus Washington D.C. – another four states have passed legislation but are not yet active – with tax rates varying widely but generally between 10% and 20% of revenue, the operator’s take after paying the winners. In total, sports betting will generate a modest $1 billion in taxable gross gaming revenue this year, with the vast majority coming from the four biggest markets of New Jersey, Nevada, Pennsylvania and Indiana.

There is a mountain of dollars that could potentially be regulated and taxed, though, considering Americans illegally bet at least $150 billion annually on sports, according to the American Gaming Associate.

A number of states have active sports-betting bills, many of which should pass. Ohio, Georgia, Massachusetts and Louisiana, for example, could potentially legalize sports betting this year. California lawmakers tried to get sports betting legislation implemented just last month that its sponsors estimated would generate as much as $700 million a year in tax revenue, but ultimately opposition from tribal-casino operators killed it.

That setback aside, by 2025, it’s widely expected that the U.S. sports betting market could conservatively be $8 billion, possibly as much as $10 billion, as more and more states open up and an increasing share of the $150 billion illicit market shifts to legal play.

People staying home during the pandemic are not only betting on sports – or ping pong, as the case may be – but there is a related source of entertainment in mobile, internet-based casino games, with real stakes and even live dealers, commonly referred to as iGaming. In the U.S., iGaming is only legal and operational in four markets: Delaware, Nevada, New Jersey and Pennsylvania. It’s also legal in Michigan and West Virginia, but not yet active.

In Europe, online gaming is much bigger. The live casino market alone, a subset of the broader iGaming market, was $2.4 billion in 2019, growing 39% over the prior year in local-currency terms, according to Stockholm-based Evolution Gaming, the global leader in live casino solutions. In markets where it’s legal, online gaming is providing endless hours of entertainment for bored would-be gamblers on lockdown.

But this trend is much bigger than a pandemic play. The digitalization of the casino industry is in its infancy, and increasing broadband internet penetration, more data capacity, improved payment solutions and higher-quality gaming experiences, combined with loosening government regulations, could drive decades of growth for the online gaming market.

Between iGaming and sports betting, state and local governments will increasingly be easing regulation to tap into this new source of desperately needed tax revenue. That you can bet on.

This article is a reprint from Forbes.com. To view the original story and comment, click here.