US sportsbooks may follow DraftKing's lead in high tax states

DraftKings CEO Jason Robins announced on Friday after an earnings call, which saw the stock price of the company drop, that DraftKings would be implementing a surcharge on winning bets for any states charging more than 20% tax. The surcharge will depend on the tax rate of the state with the ultimate goal for the company to be paying no more than 20% of revenue to states. This currently impacts New York, Pennsylvania, Vermont and Illinois, although it could affect other states that have discussed raising their tax rates.  It will not be implemented in states where the company has a monopoly with the lotteries or racetracks such as New Hampshire, Oregon or Delaware. The surcharge is set to start on January 1, 2025.

It will not be implemented in states where the company has a monopoly with the lotteries or racetracks such as New Hampshire, Oregon or Delaware. The surcharge is set to start on January 1, 2025.

Upon announcing the decision Roberts told CNBC that the company was preparing to follow other industries who effect a surcharge when the tax rate to that company is unfair.

"Whether it’s hotels, taxis or whatever else you buy (there is) generally some kind of tax."

Almost immediately several anti-tax groups in states like New York and Pennsylvania challenged the new tax policy saying that the decision shows how little the company values players in those states. And BetRivers announced it would not follow suit, which seems to quash the rumors that it had more or less finalized an agreement with DraftKings to buy out the company. None of the other operators such as FanDuel or BetMGM made any comments after Robins announced the surcharge, although they no doubt are happy to let DraftKings be the guinea pigs, and if they see no significant drop in revenue, then expect almost every other company to follow suit. BetFanatics originally said it would not go into New York because of the excessive tax rate, but it has started operations there after acquiring PointsBet. So, it is fairly certain that BetFanatics and other companies would have at least bandied about the idea of a surcharge in New York as a way of saying "if you will do nothing to lower the tax rate, we will." And New York is much more concerning for these companies than Pennsylvania or Illinois because New York only offers sports. At least Pennsylvania and Illinois offer casino games which have a guaranteed winning rate to offset some of the sports betting costs.

Not a suprise

When DraftKings made this announcement, I recalled speaking to someone from Betway at a gambling conference prior to their decision to leave the North American market who predicted that all gambling companies would start doing something to offset the crazy tax rates in many states, such as a surcharge on winning bets or adjusting lines just to be competitive. He said aside from the tax bookmakers pay in some states, which is higher than almost every other country, the U.S. climate is simply not friendly to bookmakers, forcing them to practice in a manner that is contrary to their best interests.

He noted for example, that there is a reluctance in North America from bookmakers to ban or lower limits of winning bettors as is done in almost every other jurisdiction because it is deemed an act of cowardice. But he said that as long as books feel it necessary to treat all bettors the same, the losses would just keep mounting. Consequently, he felt that charging a surtax on winnings or making the lines worse in high tax states would dissuade sharp action and would get them to move on without saying "your action is no longer welcome." He said that a $10 bettor wouldn’t notice if they get back $19 on a winning bet or $18.95, but those betting $50,000 would certainly notice. I reached out to him yesterday after Robins’ announcement was made and asked if he would be interested in an interview. He declined, but was happy to make a comment for this article.

"Companies from Europe were anxious to get into the United States because of the vast population, but no one expected it to be so uncompetitive. Between the tax, licensing requirements and rules that made it difficult to advertise, the U.S. was no longer seen as the panacea, but rather a graveyard to success. The added tax was inevitable, but I have no doubt it will drive all the big players away and with the negative publicity it will elicit most states will be back to square one. DraftKings is mentioning a 20% tax as the threshold but the ultimate goal is to pay no more than 15%, as is the case in the UK and this will be a springboard. States will have two solutions, either lower the taxes or just accept the surcharge. I’m sure DraftKings is hoping states like New York and Pennsylvania will come to their senses and lower their tax rates, but having dealt with the politicians in many of these states it’s clear that they think they’re doing their constituents a favour by allowing them to bet, which of course is ridiculous. So, the chances that the Governor of New York or Pennsylvania will lower tax rates just to be competitive is somewhere between slim and none, and slim just left home."

Taxing winnings is nothing new and many will recall the days before internet betting when North American bettors could wager at European books like Bowmans International in the UK or Intertops when they were still operating in Austria and any winning bets were subject to a 10% tax taken off the top. So, if your $50 ticket won and paid $150 for example, $10 would be taken as a tax by the bookmaker which represented 10% of the $100 winnings. That is pretty much gone except in some smaller jurisdictions, like Kenya where tax rates are exorbitant, and instead, the tax is built into the lines. It is why the same sportsbook will have a 20-cent line in some low tax countries and a 30-cent line in a higher tax country for the same game. It seems, however, that DraftKings and possibly other sites prefer to be more transparent in North America and would prefer to offer the same lines in each state with a surcharge added in high tax states as a way to illustrate that they are being ripped off by the government and not the book. In a way it would be similar to how some high tax states and Canadian provinces post the breakdown of the price per gallon/liter of gas on the pumps to show that the biggest percentage of fuel costs is taxes, so their beef with the cost of gas should not be with the gas company but rather with the government.

Real effect for bettors

As for how this surcharge would affect the bettor, it would mean that almost every bettor would be a loser in the long run. For a 20 cent line bettors have to win 54.5% of their bets to break even and this surcharge would add an average of 4% to the bets meaning that a sports bettor would have to be as successful as the best in the industry to make money and even then they would not be profitable since the U.S. unlike almost every other country in the world taxes winnings as income as well and ensures the income will be declared since books must keep track of American players and send out a WG-2 form. So, the double taxation simply makes it impossible to be profitable as no one can consistently pick winners at nearly a 60% rate.

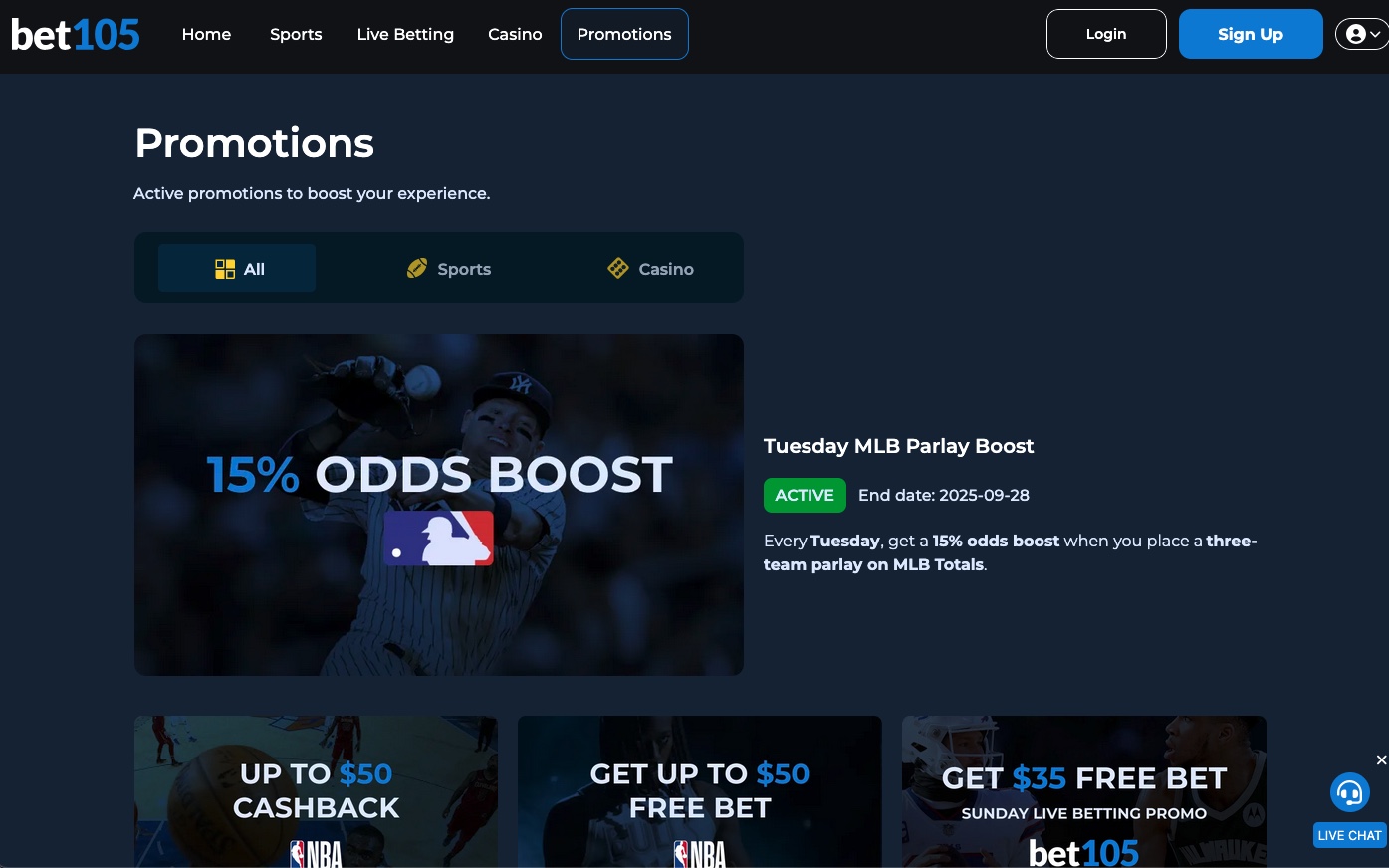

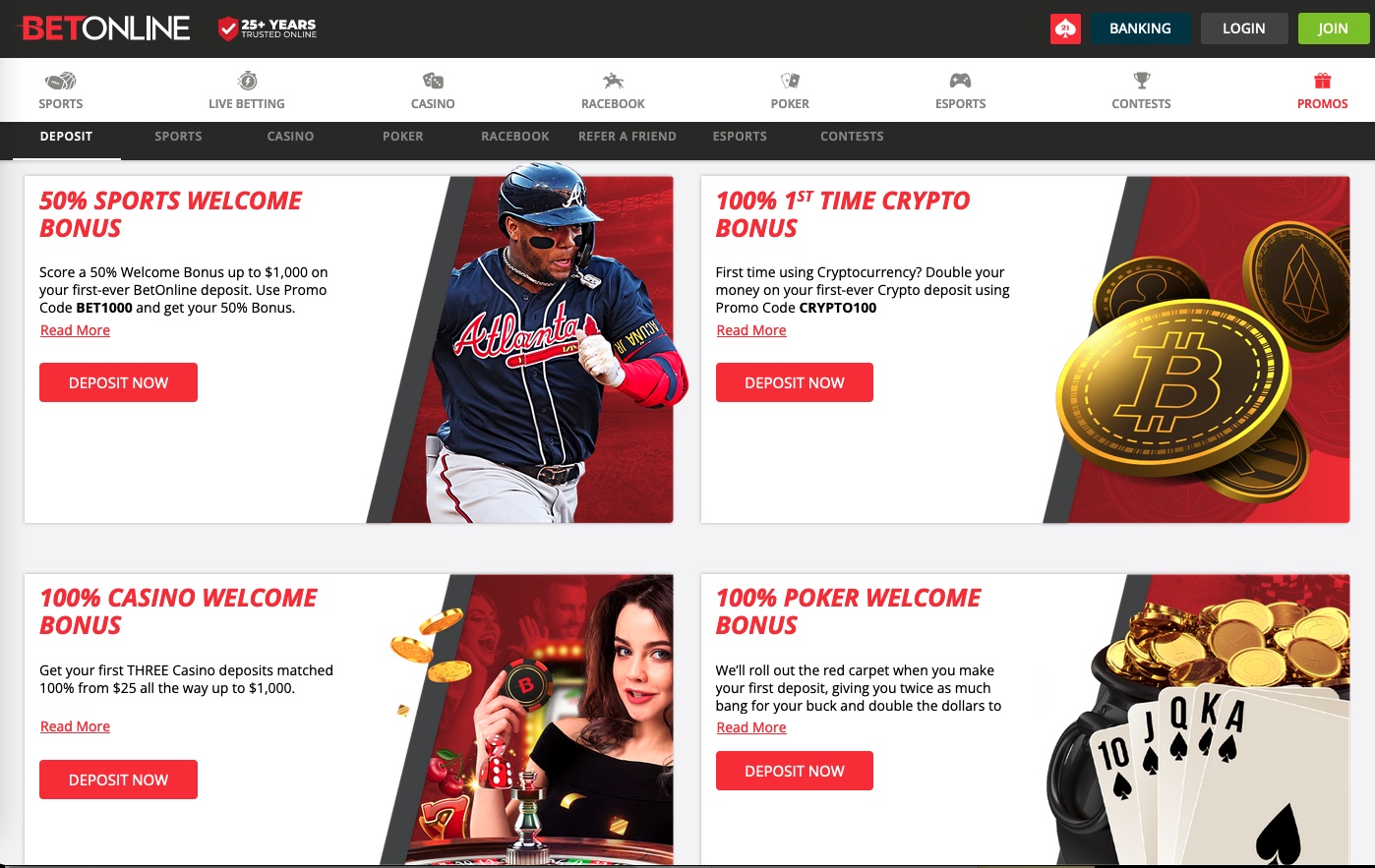

Because sportsbooks are still not profitable in the U.S., they have started to make moves to lower costs. FanDuel just released a new sports app in all jurisdictions and most bettors noticed that the very lucrative $100 or $150 referral bonus was gone for a while and just got reinstated, but with a lower bonus and just as a bet credit and casino bonus. BetMGM and BetCaesars also got rid of their referral program, while BetFanatics, ESPNBet, Bet365 and others never had one. Most books do offer affiliate programs where it is legal, but have eliminated public referral bonuses. And the very popular incentives like move the line, which was essentially free money, have disappeared. Instead, books have turned to bet boosts and no risk bet credits on 3+ game same game parlays as their promotions, which as was mentioned in a previous article have such a high hold percentage they aren't really bonuses at all.

Jim Quinn, who has running the watchdgo site OSGA.com for over 25 years suggested that instead of taking it out on bettors, the sportsbooks should find other ways of reducing their costs.<

"Maybe they should stop 'partnering' with leagues and hiring celebrities to push their products, if they feel they need to reduce costs," Quinn suggested.

I did ask an operator from a top online sportsbook if he felt that the bigger players were going to return to offshore betting if this surtax is implemented and he laughed and said "they never left. We did lose some small bettors who have no issue playing the lousy lines at their state licensed books, probably viewing it as a form of convenience fee, but the real bettors still play with us. Because we don’t have to pay the nutty taxes to the states, we can offer far better lines and we will never send out forms to the IRS. More importantly, we don’t kick out winners. We use them to help set our lines and it benefits everyone. I hope some of our casual bettors will realize that there is still a lot of value to betting in Costa Rica and we would welcome them back with open arms if they left. To be honest, we just sent out some emails to the clients who haven’t played in a couple of years offering them a bonus if they make a deposit and we were pleasantly surprised by how many have realized the grass isn’t always greener on the other side and have come back. But unlike some of the big boys with state licenses we don’t rely on the casuals to make money because we trust our bookmakers and players to be both skillful and fair and there is enough money in this business for both sides to be successful."

So, DraftKings announced it is going to add a surcharge and that decision has been met with a bit of shock, but if you believe many in the industry . . . it was inevitable. When New York announced the 51% tax rate they felt that it would just be welcomed because this is New York with the biggest city in North America and a state population of almost 20 million people. But they are quickly learning that there is a limit to what gambling operators can pay and be successful.

Is the decision a mistake or a way of the future? Time will tell, but one thing is almost certain - If DraftKings implements this surcharge and revenues do not decline, then other companies including BetRivers, which said they wouldn’t follow suit, will quickly implement the surcharge as well. As usual, the ones who will lose out are the bettors of New York, Pennsylvania, Vermont and Illinois who did nothing wrong except live in a state which believes they deserve to charge a predatory tax on sports betting, simply because they can.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!