When one thinks of the biggest names in casino resorts, the first company that likely comes to mind is MGM. A stalwart in Nevada, MGM only got into the casino business in 1973 when Kirk Kerkorian, a major shareholder of MGM Studios, opened the MGM Grand hotel (which is now Bally's). After selling that property, however, MGM decided it wanted to become a major player in the casino market and it started with the design and creation of the current MGM Grand and Signature hotels in 1991. The resort hotel was viewed as a masterpiece and included a theme park, an entertainment complex and top-class restaurants. Plus, they hosted championship boxing matches in the parking lot of the hotel. While building the MGM Grand, the company also built New York, New York on the property across the street. Throughout the next two decades MGM also acquired existing hotels on the strip including the Mirage and Treasure Island, which MGM subsequently sold, along with the Bellagio, Mandalay Bay (which owned the Excalibur and Circus Circus as well as the Mandalay Bay) and MGM Park (formerly the Monte Carlo). As well MGM acquired The Golden Nugget in downtown Las Vegas which it sold off.

Life outside of Vegas

MGM also started looking to other countries and U.S. cities to make itself the biggest name in casino resort hotels. MGM viewed itself as much as an entertainment provider as it did a hotel developer and casino management company. And MGM always contended all three were integrated – i.e. one function couldn't survive without the other two. Over the years MGM won bids and built casino hotels in Detroit Michigan, Washington D.C., Springfield Massachusetts, National Harbor Maryland, Biloxi Mississippi, Tunica Resorts Mississippi and the Borgata hotel and casino in Atlantic City. As well MGM set up a partnership for the City Center project in Las Vegas (Aria and Vdara). MGM also runs casinos at some racetracks in the U.S. and it owned but dissolved itself of many smaller hotels in other parts of Nevada. MGM also won the bid to create and run the Empire City at Yonkers racetrack once New York gives its approval. Outside of the U.S., MGM also has a partnership for casinos in Macau.

While MGM owns an impressive amount of properties it also found itself heavily in debt. Several reports indicated MGM's debt in 2015 approached $20 billion. At the same time MGM told shareholders it needed to continue to expand to grow. In an effort to clear debt and raise some extra capital, MGM created a Real Estate Investment Trust in 2016, which it called MGM Growth Properties (MGP).

The thinking of the company was that if it allowed investors to buy into some of the real estate it owned, it would allow the company to offset much of its debt. They viewed this as a better option than selling properties, particularly since the price of real estate in Las Vegas has decreased so dramatically. Unlike other REITs where the ownership is well spread out (technically for a REIT to be deemed such, no more than 50% can be owned by five investors), MGM maintained a 73% share of MGP, which assured they would maintain control over decisions relating to the casinos. The IPO was a huge success and various investors in all industries bought shares. Barrow, Hanley Global Equity Trust owns the most shares at just over 8% followed by Capital Research and Management, The Vanguard Group, Janus Capital and Brookfield Public Securities, all which own over 5% of the shares distributed (i.e. those not maintained by MGM).  MGP has performed quite well, although there are many financial analysts who are not impressed by MGP for various reasons. They are not happy that Jim Murren is Chairman of the Board of MGP and say that's a conflict of interest since he is CEO of MGM and they aren't impressed that many major shareholders keep selling their shares, making some wonder if the profits are real. I spoke to one financial analyst who said he would never tell anyone he invests for to buy MGP and wonders if it's a house of cards:

MGP has performed quite well, although there are many financial analysts who are not impressed by MGP for various reasons. They are not happy that Jim Murren is Chairman of the Board of MGP and say that's a conflict of interest since he is CEO of MGM and they aren't impressed that many major shareholders keep selling their shares, making some wonder if the profits are real. I spoke to one financial analyst who said he would never tell anyone he invests for to buy MGP and wonders if it's a house of cards:

"On paper MGP looks like a gold mine. It's profitable and has key investment funds excited. But I must wonder if it's not hype. Casino revenue from gaming is up, but ancillary revenue from hotel room rentals, show tickets and food sales is not. There is also a lot of disdain from Vegas regulars who are sick of resort fee hikes and they claim Vegas casinos are nickel and diming them to make up for lost gaming and resort revenue. Even convention traffic seems to be looking elsewhere. And for places like Detroit and Biloxi, let's face it, MGM was expecting better. Funny enough, MGM doesn't get excited when you discuss the assets in MGP they only get excited about Empire City at Yonkers Raceway, Macau and the possibility of a casino in Japan. Truthfully, I think if MGM had their way, they would be rid of all property ownership in the U.S. and would just manage the resort casinos. There is always money to be made running the casinos, but land ownership is a crapshoot. There is no reason to believe the financial crash of the 2007 couldn't happen again."

Not the first rodeo for MGM

Of course, this wouldn't be the first time MGM went all-in to win a casino bid in a foreign market. When the province of Ontario indicated it was interested in having a company build a resort casino in Toronto, MGM went for it. Caesars and the Las Vegas Sands made a small pitch, but MGM apparently spent almost $10 million in trying to win that bid for a casino on the Ex grounds. Like with Osaka, they talked about spending billions on developing the casino, they promised up to 10,000 high paying jobs, they agreed to pay for changes to the  transportation system and they said Toronto would benefit greatly from a profit share. Of course, despite the huge bid and support from the Toronto mayor, the city council turned it down flat and someone handling the bid acknowledged that the bid never stood a chance of passing and that it was a lot of money wasted. He added that had he known what a dysfunctional local system he was dealing with, he would never have bothered with the bid. Aside from Japan, MGM is also eyeing other areas in Asia, as well as Brazil. Like Japan these are untapped markets that could provide an untold amount of revenue unlike Nevada and various other cities where casinos are already built, competition is high and the likelihood of getting new customers is slim.

transportation system and they said Toronto would benefit greatly from a profit share. Of course, despite the huge bid and support from the Toronto mayor, the city council turned it down flat and someone handling the bid acknowledged that the bid never stood a chance of passing and that it was a lot of money wasted. He added that had he known what a dysfunctional local system he was dealing with, he would never have bothered with the bid. Aside from Japan, MGM is also eyeing other areas in Asia, as well as Brazil. Like Japan these are untapped markets that could provide an untold amount of revenue unlike Nevada and various other cities where casinos are already built, competition is high and the likelihood of getting new customers is slim.

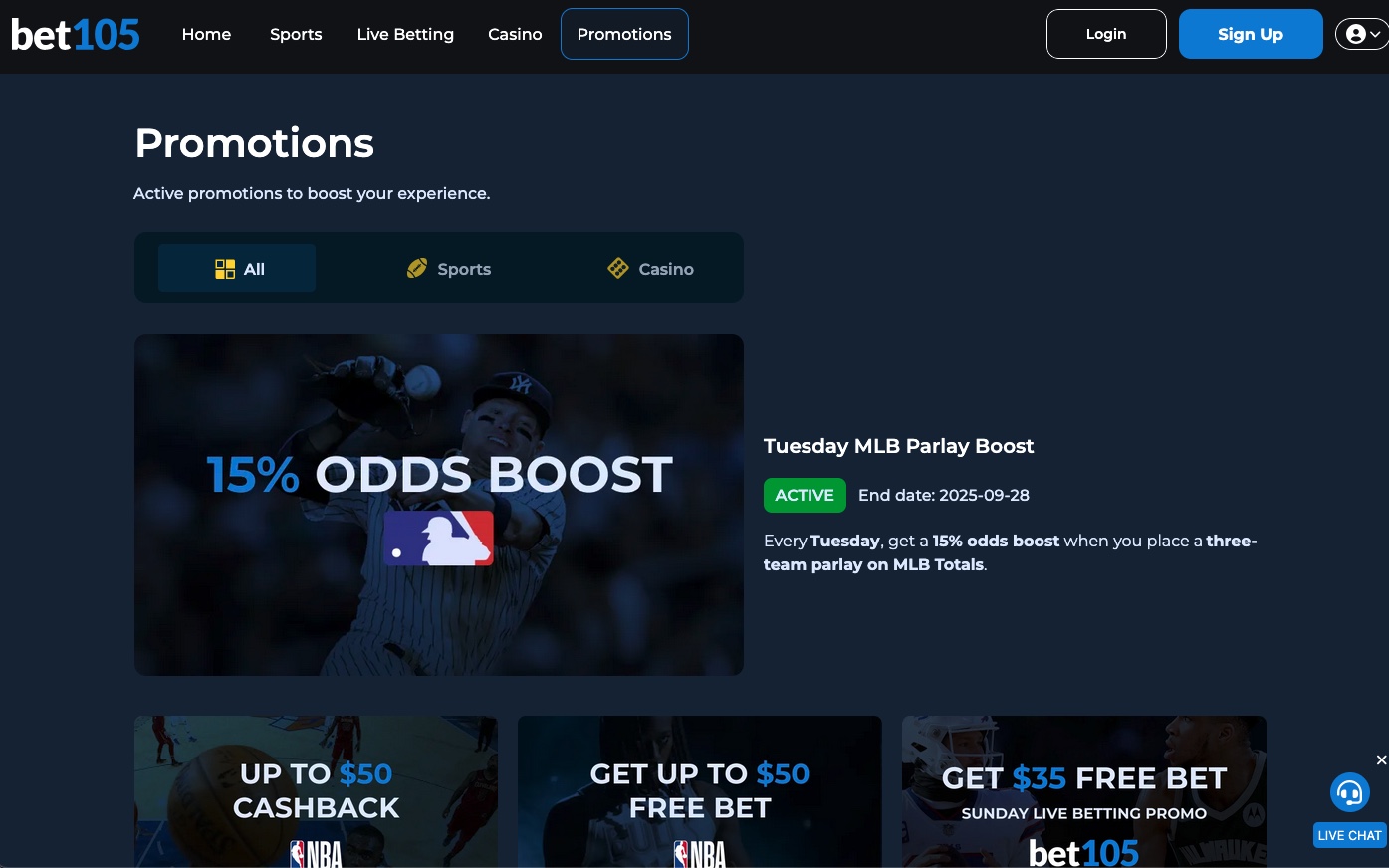

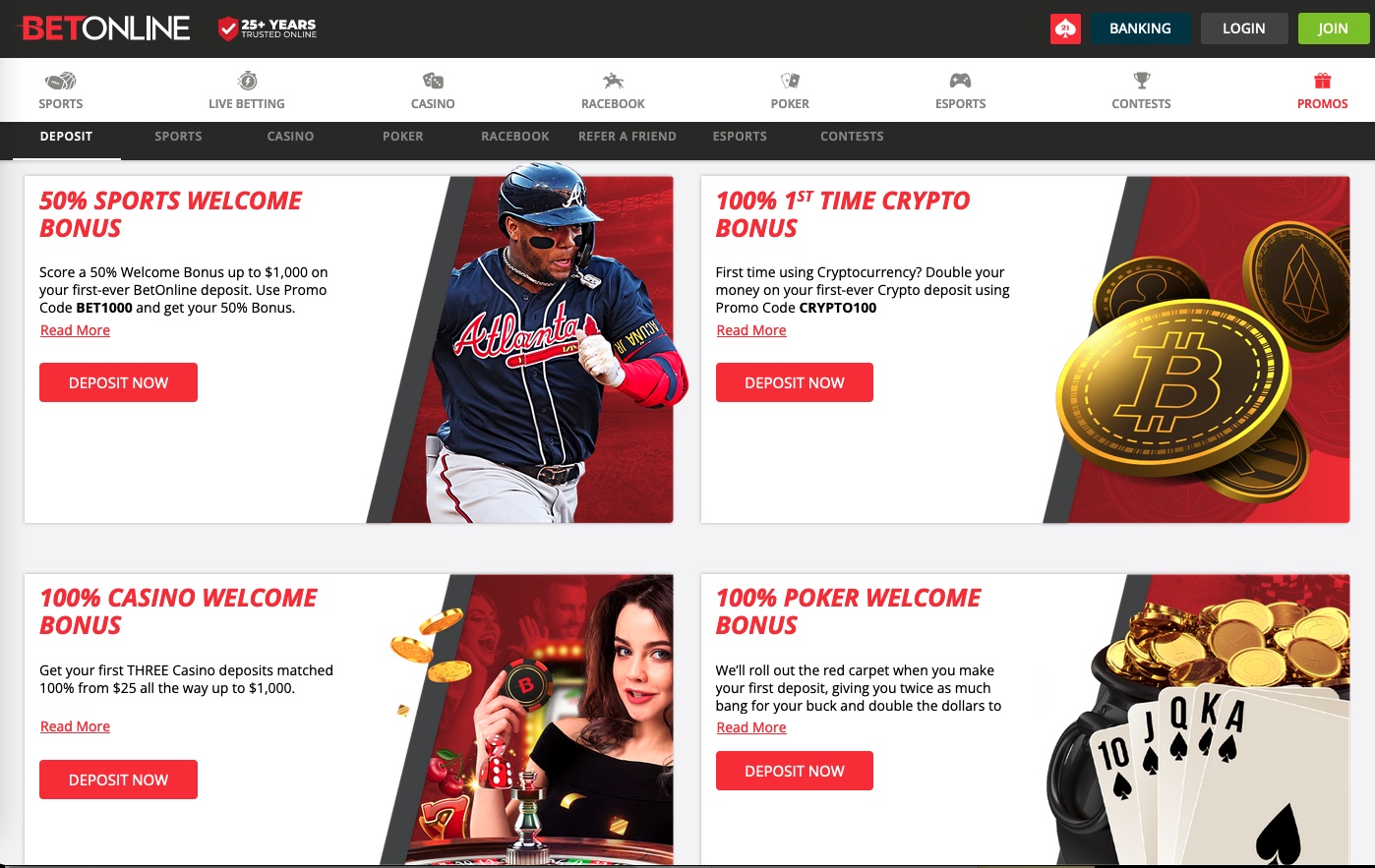

MGM has also said it is very interested in pursuing sports betting, believing that could be a huge money maker in the future in the U.S. now that the Supreme Court repealed PASPA. Most states seem to be putting sports betting options at racetracks and smaller existing casinos as well as online. So, it is very conceivable that MGM views this as desirable since it gives them a chance to oversee managing the betting and venue without being committed to any more land ownership.

MGM at a crossroads

They clearly view their huge debt load as a concern, but they also want to pursue larger foreign and emerging markets. Their solution appears to be to sell under-performing properties outright to lower debt or sell more profitable properties and then lease them back from the companies that buy those properties. It’s untraditional, but MGM has the personnel and planners that could make it work. Let's just hope that those pursuits of Osaka and Brazil go better than Toronto for MGM.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!