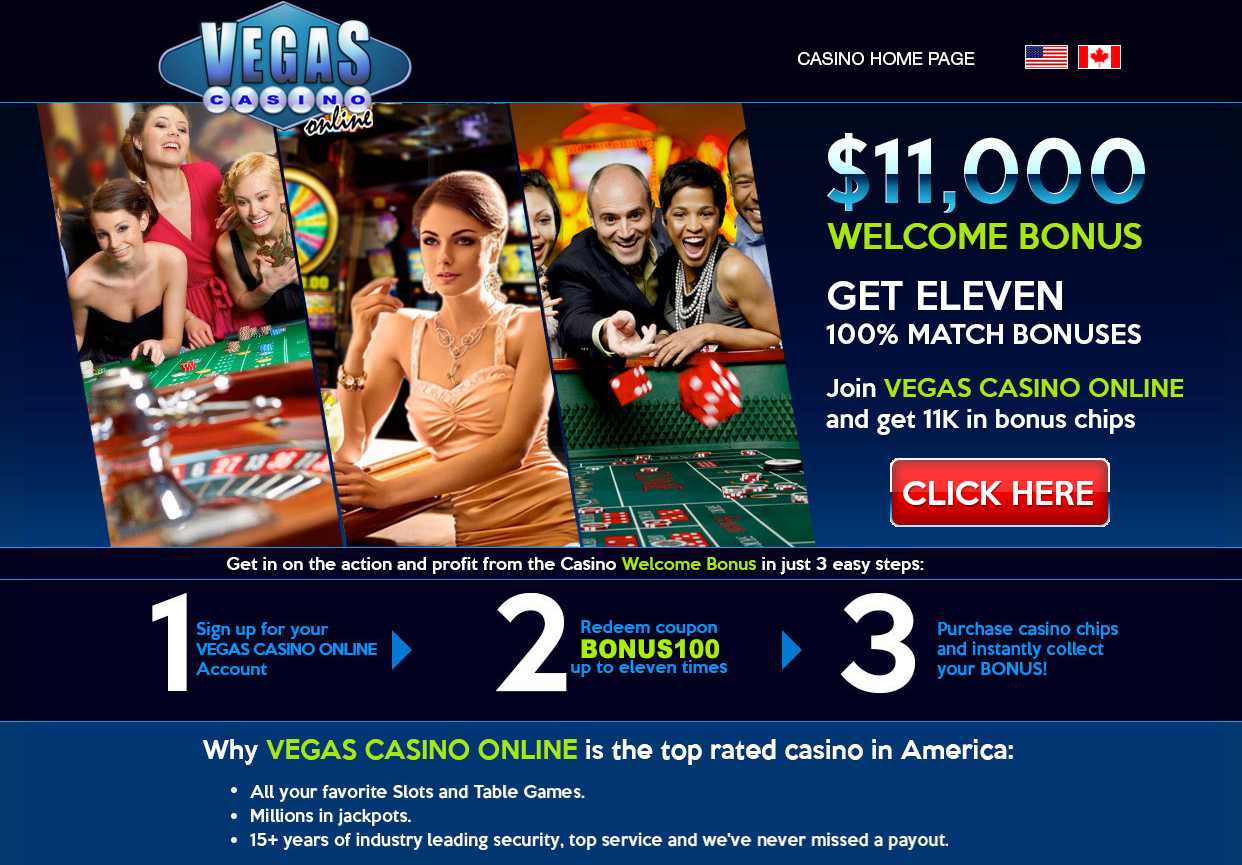

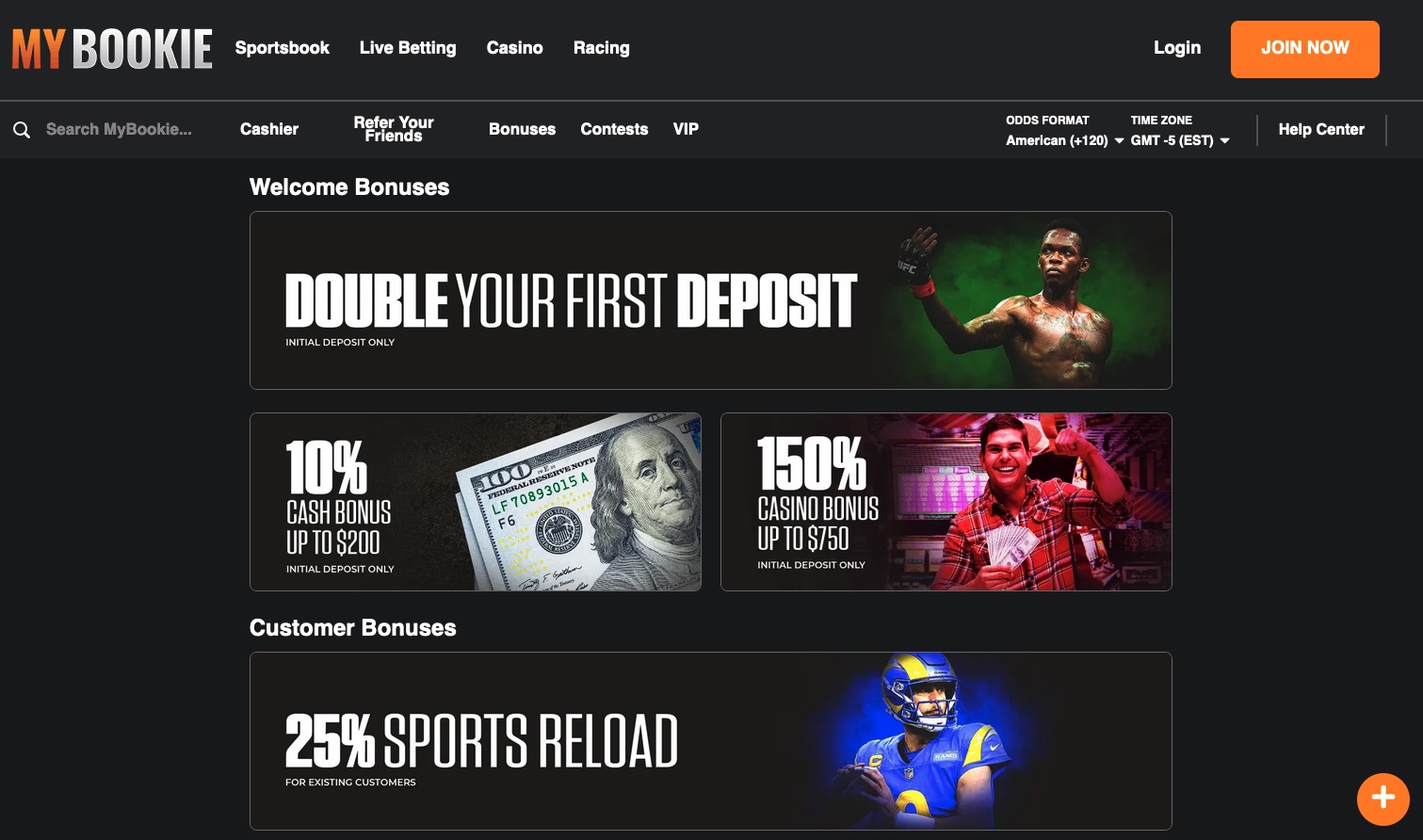

Peruse a major betting site in late-October on one of the busiest sports weeks of the year and you will likely spot an attractive promotion as soon as your eyes touch the page.

The promotions run the gamut from “risk-free” sign-up bonuses, boosted bets, close loss “insurance” offers, cash-outs, multipliers and many more. For operators in the hyper-competitive New Jersey market, the promotional deals have a dual objective. A sportsbook intent on increasing market share can maximize customer acquisition, and second, increase retention through clever promotions.

The can’t miss deals are ubiquitous. Over the last few weeks, BetMGM has run an appealing 100-1 promo as the platform continues its rebrand from PlayMGM. One awarded new customers with $100 on a $1 bet for a simple Week 7 moneyline wager on the San Francisco 49ers (-455) over the Washington Redskins. An offer at DraftKings over in June refunded customers $3 for every made 3-pointers by Steph Curry in Game 3 of the NBA Finals. DraftKings offered the promotion to customers who bet at least $20 on Curry to score over 31.5 points (-134).

With Klay Thompson sidelined by a knee injury, Curry drained six threes for 47 points. Curry exploded for 17 first-quarter points, then hit the over midway through the third quarter to produce an easy win for DraftKings customers.

Budgeting for sportsbook promotions

Just as grocery stores sell turkeys for rock bottom prices as loss-leaders to woo bargain hunters, sportsbooks will continue to engage in a cutthroat pricing war for the foreseeable future, according to Chris Grove, a partner at Eilers & Krejcik Gaming. Grove oversees the firm’s sports betting practice.

“It’s a race to the bottom, ultimately,” Grove said Oct. 14 during a sports betting presentation at the 2019 Global Gaming Expo (G2E). The prolonged battle among New Jersey sportsbooks represented one of the hottest topics at the three-day conference, the largest gathering of global, commercial and tribal gaming professionals in North America each year.

The question is how long will the pricing war last?

When FanDuel Sportsbook launched in New Jersey, the company built its strategy around simplicity and creating a fun customer experience for bettors. Given its proximity to New York City, FanDuel surprised New Jersey market participants by boosting the odds on the Yankees for win bets, said Kip Levin, president and COO of FanDuel. While New Jersey bettors expected FanDuel to lower the price on Yankees’ contests, FanDuel took an alternative approach. Instead, the sportsbook operator designed attractive odds for bettors in order to enhance the customer experience and build a long-term relationship, he added.

“You have to know what your sustainable customer acquisition costs are,” Levin told Sports Handle. “We build it into our projected margin, we build it into our retention and our acquisition spend.”

Although certain promotions can create downward pressure on margins, FanDuel strives to design strategic promotions that are sustainable for the company’s business model. Companies that are unable to properly measure the costs associated with promotions may lag behind, Levin emphasized. FanDuel, however, is thoughtful in how it structures the promotions placing the customer acquisition and retention expenses into various cost buckets.

Similarly, PointsBet Sportsbook is mindful about building promotional cost buckets into its margins, according to Ron Shell, vice president of Customer & Insights at PointsBet USA, LLC. Shell recently relocated to the U.S. from Australia where PointsBet began its operations in 2017.

For the start of the NBA regular season, PointsBet rolled out an aggressive promotion aimed at attracting hoops bettors to closely contested games and blowouts alike. Over the first five nights of the season, place a $100 spread wager on an NBA team and PointsBet will refund you $3 for every three-pointer hit by the team. Last December, the Rockets set an NBA record for three-pointers made in a contest with 26 threes in a 149-113 win over the Suns. Hence, a bettor could recoup most of their losses in a defeat if their team is proficient beyond-the-arc.

PointsBet employs a quants team that develops models for each major promotion. In the case of the Rockets, the team could weigh considerations such as the number of three-pointers made by Houston per game, the amount allowed by the Suns per contest and individual matchups. The models also take into account the maximum amount wagered by bettors in the promotion, the expected number of customers taking part, as well as acquisition and retention expectations.

Tailoring promos

PointsBet goes one step further by developing customized promotions based on a user’s betting profile. Operators that take a one-size-fits-all approach with developing attractive promotions still need to be efficient with their budget by spending wisely, Shell said. A PointsBet customer who wagers 90% of his bankroll on Big 12 college football might have little interest in a World Series promo.

“You’re going to waste a lot of promotional money that could have been spent much smarter,” Shell told Sports Handle. “You might entice them once or twice, but it might not be the main retention tool to get them betting consistently.”

For that type of bettor, PointsBet instead could offer a customized parlay on a pair of quarterbacks before kickoff. Will Sam Ehlinger and Jalen Hurts combine for more than 600 yards on Saturday at a boosted price? In the near future when a user logs onto PointsBet, he could be greeted with a unique prop featuring his preferred teams and bet types rather than a generic promotion. PointsBet is working on developing such a customization.

Astute customers, meanwhile, have found ways to capitalize on arbitrage opportunities. At FanDuel, one New Jersey bettor placed $80.26 on the first-inning total (Over 0.5 runs) of the Nats-Brewers’ Wild Card matchup at +112. At the same time, he locked in a risk-free profit by betting $83.02 on a zero-run total at DraftKings (+105).

The same bettor played four NFL games on Oct. 20 with FanDuel’s close loss insurance promotion. If your team loses by six points or fewer, FanDuel will refund your account on a moneyline bet up to $50. A bettor can wager $50 on the favorite, then enlist a friend to wager the amount needed on the underdog to guarantee at worst, a small loss on the vigorish. On the afternoon, he hit two games: the Cardinals 27-21 win over the Giants and the Titans 23-20 victory against the Chargers.

In September, two New Jersey licensees, Resorts Digital Gaming and the Meadowlands (FanDuel and PointsBet) brought in more than $20 mm in sports betting revenues, continuing their domination of the market. When revenues from the retail FanDuel Sportsbook at the Meadowlands Racetrack and the DraftKings land-based book at Resorts Casino were factored, the figured swelled to approximately $28 mm, representing about 73% of the Garden State’s market share for the month.

Long-term viability

The market is near a tipping point for promos, Shell explained. Once the football season ends, he expects a large dropoff for the strength of promotions and even the number of providers down the road. At the moment, New Jersey’s crowded marketplace contains nearly 20 online providers, setting the stage for potential consolidation in the near future. He expects operators to ramp up promotions for March Madness before reassessing margins by the start of the 2020 football season. By then, customers will be comfortable with a sportsbook of their choice, fewer operators will look to establish market share and promotions could be less appealing, Shell notes.

Industry executives on a panel with NHL Commissioner Gary Bettman at G2E also devoted several minutes to the ongoing pricing battle. In response to a question on boosted bets, Rush Street Gaming CEO Greg Carlin called out companies for attempting to grow market share at the expense of handing out too many promotions. William Hill US CEO Joe Asher said operators who are overly aggressive in New Jersey while maintaining a low theoretical hold are pursuing an unsuccessful business strategy. Over the course of his career, Asher said he has run his companies with the objective of offering customers a fair price.

Time will tell. There’s no love lost between Asher and Jason Robins, CEO of DraftKings, which is off to a hot start in New Jersey and recently entered Indiana. The DFS-operator-turned-sportsbook has offered aggressive promotions such as $500 “risk-free” bets and large deposit matches.

Savvy operators may need learn to attract customers in other ways. Asher points to Starbucks as a case study. Technological innovations allow Starbucks’ customers to order in advance to avoid a crowded line. Once there, Starbucks’ mobile app makes it easy for customers to pay and reload their account, Asher explained. Sportsbooks could take a page from top Fortune 500 companies to avoid a death spiral when it comes to pricing.

“There are other things than just pure price, otherwise it will be a losing battle,” Asher said.

This article is a reprint from SportsHandle.com. To view the original story and comment, click here.