Casinos and sports books can do more to fight problem gambling

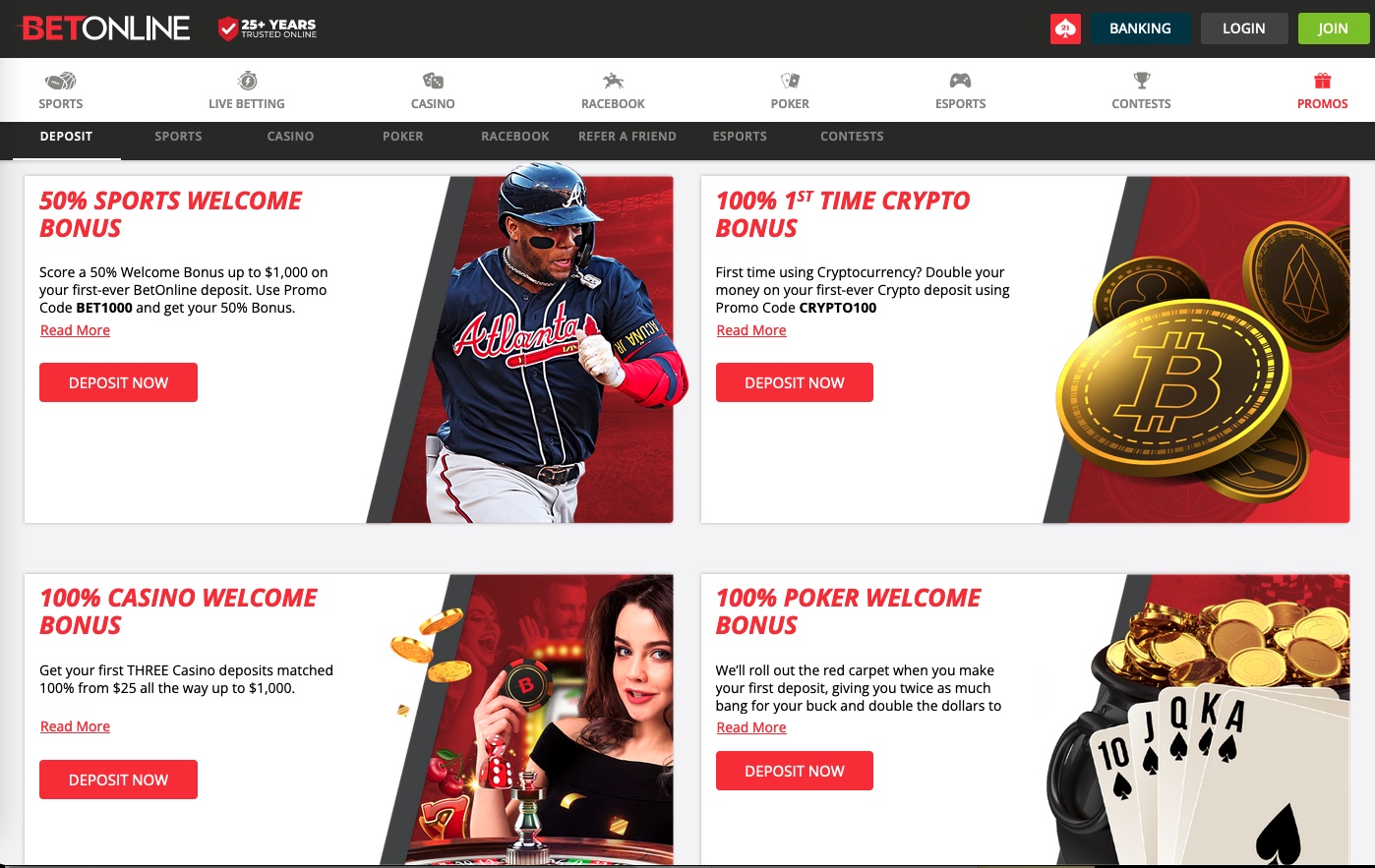

In an effort to combat compulsive gambling, the UK Gambling Commission (UKGC) announced that as of April, sites that operate with a UKGC license will no longer be allowed to accept credit card deposits. According to statements, companies located there like GambleAware, Gamstop and Gamcare, whose purpose is to lobby for protections to combat problem and compulsive gambling, petitioned the UK Gambling Commission to remove credit card deposits as a deposit option in an effort to ensure problem gamblers cannot go in to debt to gamble. They pointed to a National Health Survey (NHS) study which showed that of the 24 million Brits who gamble, 800,000 use credit cards to deposit and 22% of those people have been identified as problem gamblers. The NHS concluded that when people bet with money in their own personal accounts, they are far more responsible.  The UKGC is also looking at applying the ban to e-wallets as well, meaning that companies like NETeller, Skrill and PayPal will not be able to process payments that were made via credit cards to gambling companies. That may be easier said than done, however, since often deposits are from the remnants of credit card deposits designated elsewhere. For example, someone will often put $100 in their PayPal account via credit card to cover a purchase on eBay but then after the purchase they will have a credit on their account which they deposit to a gambling site. It's hard to see how the UKGC will be able to prevent that or even if that qualifies as a credit card deposit. It's also uncertain if the ban will only apply to UK credit players and UK credit cards or if players from the rest of the world would be excluded from using credit cards from their countries as well. Once the ban goes through, the list of deposit options would be limited to debit cards, prepaid visa or master card gift cards, checks and prepaid options like the Paysafe card, where someone uses cash or a debit card at a local retailer to buy a paper with a pin number that can be used for all online purchases, including gambling. No doubt when the ban comes into play many gambling sites holding a UKGC license will start looking at bitcoin and other cryptocurrencies as well, just as offshore gambling companies targeting U.S. customers are doing now.

The UKGC is also looking at applying the ban to e-wallets as well, meaning that companies like NETeller, Skrill and PayPal will not be able to process payments that were made via credit cards to gambling companies. That may be easier said than done, however, since often deposits are from the remnants of credit card deposits designated elsewhere. For example, someone will often put $100 in their PayPal account via credit card to cover a purchase on eBay but then after the purchase they will have a credit on their account which they deposit to a gambling site. It's hard to see how the UKGC will be able to prevent that or even if that qualifies as a credit card deposit. It's also uncertain if the ban will only apply to UK credit players and UK credit cards or if players from the rest of the world would be excluded from using credit cards from their countries as well. Once the ban goes through, the list of deposit options would be limited to debit cards, prepaid visa or master card gift cards, checks and prepaid options like the Paysafe card, where someone uses cash or a debit card at a local retailer to buy a paper with a pin number that can be used for all online purchases, including gambling. No doubt when the ban comes into play many gambling sites holding a UKGC license will start looking at bitcoin and other cryptocurrencies as well, just as offshore gambling companies targeting U.S. customers are doing now.

I spoke to an addictions counselor who was originally based in the UK and now is practicing in Toronto and asked if he believed the new rules would make a difference. He made it clear that most of his clients have addictions to narcotics and alcohol, but he has had clients in both Canada and the UK who were desperate after getting into heavy debt due to gambling.

"I applaud any initiatives that make it more difficult for addicts to acquire money to feed their addictions, and I think this will make a difference," the counselor said. "The purpose of credit cards is to allow people to acquire something now and pay for it later and that always causes issues. Whether it's compulsive shoppers or gamblers they are almost always looking for the quick fix and are not thinking about the ramifications down the line. Of course, that's true for all addictions, but when an activity is illegal the credit card option isn't available since no drug trafficker is going to take Visa. In order to fulfill their need the opioid addict generally needs to venture to the bank, make an ATM withdrawal, (whether it's made by debit card or credit card), arrange for the buy and then acquire the narcotics. It's a process that takes time and one thing we always teach is that time is the biggest factor in helping to stop addiction.

With gambling, someone can just go online, make a quick deposit and the money is there to fuel their addiction. I see it happen all the time. Someone will make bet on a football game. At half their team is down 3 nil so they are clearly going to lose the bet. Rather than just giving up, they deposit more money and bet more on the game (perhaps on the 2nd half line) hoping to break even. And with casino gambling it's even worse. Online slots and table games today are like video games and are very addictive. So, if someone loses money quickly, they'll almost always deposit more to try and get back in the game. Very rarely can a person play for five minutes, lose the money in their account and just turn off their laptop or tablet. Naturally the person can deposit by other methods, but from what I've seen, if the money comes directly from a bank account, there will be more hesitation than there will be from a credit card deposit, since credit cards require future payments. And as I mentioned, most addicts don't really think about the future ramifications."

The counselor continued, however, by saying that the ban on credit cards isn’t enough and that if the UKGC really wants to address problem gambling they need to do more to actually stop the bettor himself or herself. That would include becoming more intrusive, which would cause a lot of pushback from the industry and from companies that are opposed to intrusive behavior.

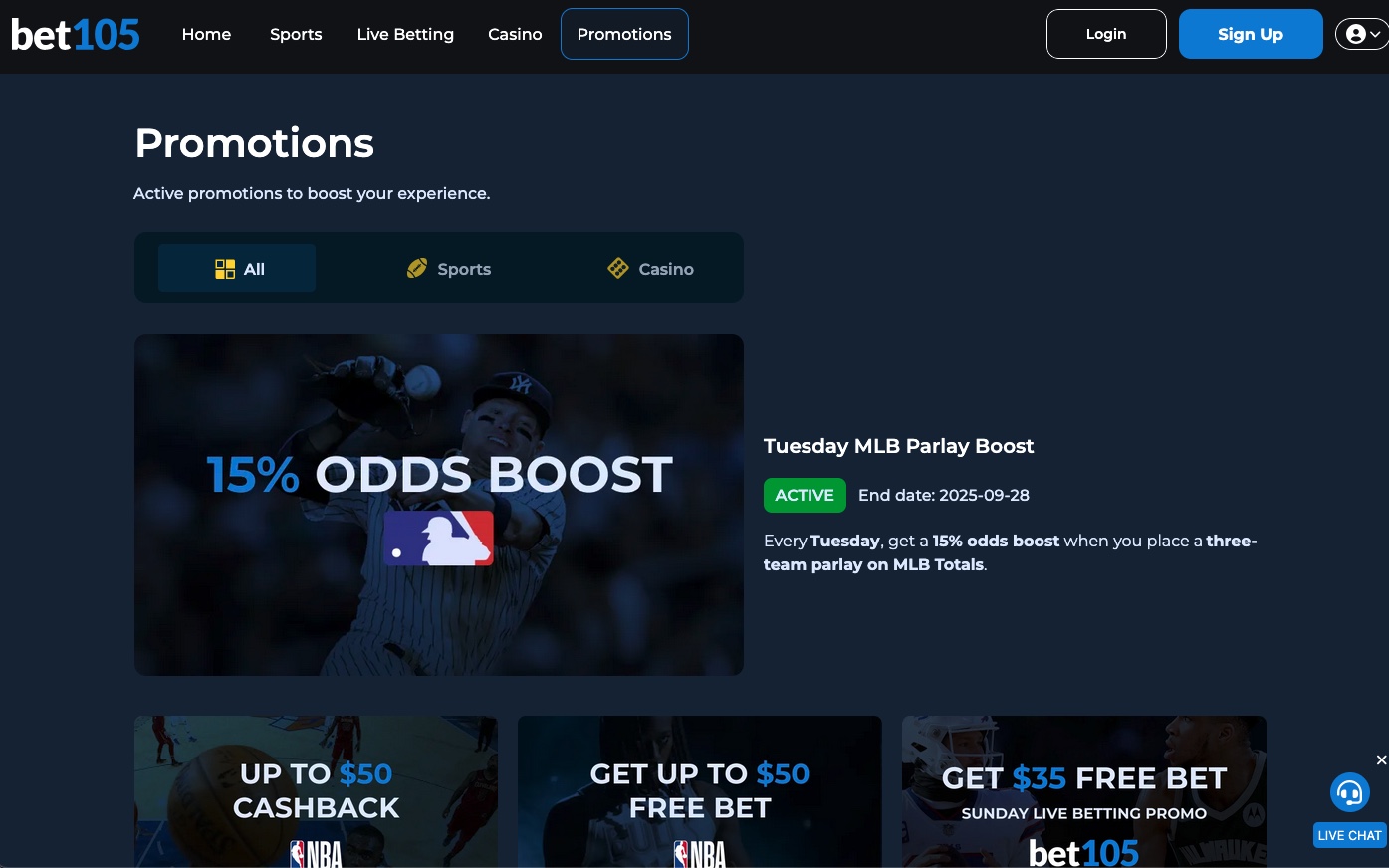

“When I do see problem gamblers it’s almost always because they are close to bankruptcy and desperate and what really frustrates me is I know the gambling companies could have done more to prevent that. I always shake my head when I see ATM machines in gambling establishments. In the day you went to the racetrack with a bankroll and once that money was gone you had to leave. Now with ATMs the access to money is endless. And that includes both withdrawals from bank accounts and credit card withdrawals. If those ATM machines didn’t exist at the casino the person could still go to the closest ATM outside of the casino and make the same withdrawal, but it’s been proven many times that if someone is forced to take time away and make an effort to withdraw money they are more likely to have second thoughts and resist the temptation to make more bets, at least for that day. Time is the biggest factor in helping to fight addiction. And with online casinos it’s even worse. The gambling sites rarely monitor or restrict the amount that can be deposited and when they do it’s a futile effort such as having the bettor set deposit limits. I’ve never heard of any reality checks being performed and both I and a few associates have discussed whether it’s time to initiate reality checks. Let me explain.

If someone wants to get a loan at a bank, they will almost always have to go through a credit check where the banks will determine if the person can truly afford the loan. They look at assets, expenses, money on hand, credit ratings and spending patterns and only then will then decide whether to approve the loan. That is what I would like to see done with gambling. A true KYC (know your customer) initiative would ensure that the gambling site knows absolutely everything about the person and then they can determine whether they are capable of gambling online. My son likes to gamble online. And even though I discourage it, he assures me he is responsible. I watched him wager at the Ontario gambling site where he was playing minimum wagers on slots. After about 30 minutes he lost his initial deposit so with a click he deposited more by Interac (a deposit method where money is taken directly from the bank account). He proudly said that the site was responsible since he set up a $500 weekly deposit limit which he couldn't exceed. He also showed me how the website kept track of time played and after each hour a popup appeared asking if he wanted to take a break. I checked with friends in the United States and discovered it’s pretty much the same at all online gambling sites in North America. But all I could think to myself is "that's it?" $500 a week isn't going to bankrupt my son, but to those making minimum wage or who have a huge debt load, $500 could be a king's ransom. The last person that came to me was in tears because she was $2,500 in debt due to gambling and didn't know how she could make her next rent payment. A reality check would have determined if the person could truly afford to lose that much. And let's be honest, the time tracker is meaningless. What would be far more meaningful is if a live person came online after an hour and talked directly to my son about his other expenses, the time he was taking to play the games and whether he was neglecting his family, work or responsibilities to gamble. Only then when they truly got to know more about my son and determined he was not betting over his head and not neglecting other areas could they attest they did enough." The counselor conceded that this will likely never happen since it doesn't occur in physical casinos, but he said that online gambling is in its infancy and the technology surely exists to do more to ensure that people aren’t gambling beyond their means. In the meantime, he said he’s disgusted at how little is currently being done in North America.

The counselor conceded that this will likely never happen since it doesn't occur in physical casinos, but he said that online gambling is in its infancy and the technology surely exists to do more to ensure that people aren’t gambling beyond their means. In the meantime, he said he’s disgusted at how little is currently being done in North America.

That got me to wondering whether it's time for casinos, racetracks and the growing number of legal sports betting companies in the U.S. to follow the UKGC lead and ban the use of credit cards for gambling. I spoke to a colleague who said it would be a good idea just based on his personal experience.

"My wife and I have a joint account that we use for all our daily expenses. We keep track of it and we know what’s going in and coming out. I also have a small separate account with a $400 limit that I use for gambling. My wife knew that I liked to bet offshore, and she was OK with it, as long as I didn't exceed that amount, since we determined that was a reasonable amount we could lose monthly without it being a concern. Often by the 15th of the month I would say that the $400 was used up and she would laugh and say well you only have 15 days before it’s replenished. What she doesn't know is that I also have a credit card with a large limit that I use for gambling as well. I am proud when I can keep the wagering to the $400, but more often than not, I’m making $50 or $100 deposits weekly if not more often so I can continue betting. I only secretly pay the minimum payments on the credit card and it adds up. About two years ago the balance approached $4,000 and I remember thinking to myself if I could only get that big hit so I could pay off that credit card once and for all and I would cut it up. Shockingly it happened! I won a parlay that paid almost $4,500. I withdrew $4,000 and paid off the credit card, but I didn't cut it up. Now 2 years later the balance is almost at that level again. I know it's wrong and I know I can't afford it, but I also know I won't stop unless the online companies do something about it. If I was told I could no longer use my credit card to bet I would be disappointed, but deep down inside I’d be very thankful. What I do know is that I don’t really think about the credit card deposits until the statement comes. And after I make a minimum payment, I don’t think about it again until the next statement comes. And when it gets up there, I am sick to my stomach. I know there are a lot of people like me out there who need help and the best thing the offshore sportsbooks and local online casinos can do is to remove credit card payments as an option. But I’m also not stupid. They won’t do that because it would eat directly into their profits."

While I generally don't look at gambling addiction in my articles, everyone in the industry knows it's an issue. It’s not something they like to discuss, and most gambling site managers have said that if they could truly stop addicts from betting, they would do so. The rewards for money made from problem gamblers does not offset the negative publicity, lawsuits and hardships that gamblers endure and, more often than not, now tell on social media. And there is enough money to be made from gamblers who are not addicts. The UKGC has made a major decision to try and address gambling addiction by blocking credit card deposits and most in the industry are giving the thumbs up. I have yet to speak to one UK gambling site who is publicly opposed to the idea. The question is whether the U.S. and Canadian government have the nerve to follow suit.

From the time John Kyl introduced his Internet Gambling Prohibition Act until the last state licenses and regulates sports betting, the first concern has been what to do to prevent underage and problem gambling. The North American governments should show they are listening and are trying to do something about it by blocking credit card deposits online. And if they truly want to show they are taking it seriously, disallow credit card deposits at ATMs in physical locations as well. Only then will they be able to say that they are taking major steps to address the problem.

Read insights from Hartley Henderson every week here at OSGA and check out Hartley's RUMOR MILL!